As we highlighted in our earlier blog post, the April employment report was a mixed bag, at best, with a slowdown in hiring, a pickup in wages, and ongoing weakness in temporary help jobs—a key forward-looking metric. Upon further review, the report still looks mixed, but highlights a long simmering disconnects between “the market” and the Federal Reserve (Fed) on the labor market.

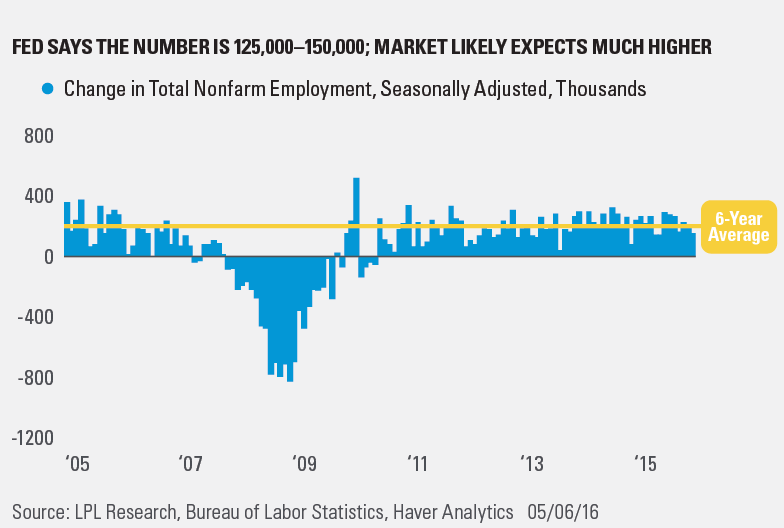

We point out that the economy has created an average of 200,000+ jobs per month in the past 12 months—despite the tepid reading (+160,000) in April—and there is even a case to be made that the weaker than expected April reading was “payback” for warmer/drier than usual weather in the first quarter of 2016, which may have artificially boosted job counts in that quarter. In a series of public appearances over the past few years, Fed officials noted that monthly job gains as low as 120,000 per month would still be enough to tighten the labor market, take up slack in the economy, as well as push up wages and ultimately inflation. (For more detail see our Weekly Economic Commentary, “Lowering the Bar.”)

On the other hand, it’s our sense that the market would likely view a downshift to job creation of 120,000 jobs per month—or even 160,000 per month—as a sign of a slowing economy, and begin to worry about global growth and the onset of recession.

Based on where we are in the business cycle and the recent downshift in temporary help jobs (a decent leading indicator of future job growth), we believe that by the end of 2016, job growth will more routinely be in the 120,000 to 150,000 per month range, a clear deceleration from the 200,000 per month pace seen, on average, over the past six years. At that point, some market participants may be expecting the Fed to ease; but the Fed, all else equal, will likely be tightening. Yet another disconnect between the Fed and the market to worry about.

IMPORTANT DISCLOSURES

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The monthly jobs report (known as the employment situation report) is a set of labor market indicators based on two separate surveys distributed in one monthly report by the U.S. Bureau of Labor Statistics (BLS). The report includes the unemployment rate, non-farm payroll employment, the average number of hours per week worked in the non-farm sector, and the average basic hourly rate for major industries.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking # 1-495447 (Exp. 05/17)