KEY TAKEAWAYS

- The Fed poses a potential threat to the recent improvement of lower-rated, more economically sensitive bond sectors, such as high-yield bonds and risk assets overall.

- A softer tone from the Fed is expected and failure to deliver could lead to renewed volatility.

Click here to download a PDF of this report.

The real question investors will grapple with at the conclusion of this week’s Federal Reserve (Fed) meeting is whether the Fed is pro-growth (a friend) or a potential threat (foe) to financial markets. Market volatility increased following the Fed’s interest rate hike in December 2015; financial conditions tightened, or became less conducive for economic growth, before loosening in the past few weeks as extreme pessimism faded. Although interest rates remain low by historical standards, the market’s behavior in 2016 has clearly shown discomfort with the prospect of four interest rate hikes in 2016.

Now, the ball is in the Fed’s court to meet rising expectations that its forecast of future interest rate hikes (known as the “dot plots”), last updated in December 2015, are too aggressive and need to be revised downward.(Please see this week’s Weekly Economic Commentary for details.) Failure to reduce forecasts may disappoint investors who view gradual rate hikes as potentially restricting future economic growth. Additionally, continuing to describe low inflation or overseas risks as “transitory” may come across to investors as out of touch with reality.

OVERSEAS ACTION

Will the Fed continue to run counter to global central banks? In an increasingly global financial world, the Fed also does not want to appear out of touch with global developments. Over the past year, more than 20 central banks worldwide have lowered interest rates. Last week, the European Central Bank (ECB) overdelivered by increasing the amount of monthly bond purchases, broadening purchases to include non-financial corporate bonds, and easing terms further on bank lending programs that were successful in boosting economic growth after the 2008 recession. This week, the Bank of Japan met investor expectations by suggesting that additional stimulus may be on the way, after acting aggressively in February.

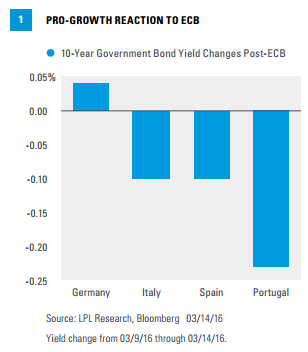

Financial market reaction to the ECB actions qualifies as pro-growth. Since the ECB’s decision last Thursday (March 10), yields on top-quality German bunds have increased (in anticipation of better economic growth) and yields on lowerrated, more economically sensitive peripheral European countries have declined (in anticipation of less risk) [Figure 1]. Corporate bond prices have also increased, with yields declining in response to corporate bond purchase announcements.

The yield increase on the 10-year German bund is modest at just 0.04%, as friendly central bank policy and the potential for more is generally supportive of high-quality bond prices. It also remains to be seen just how effective the measures will be, but the ECB has certainly done what it can. The difference between segments of the market in response to the ECB is striking.

FED ON DECK

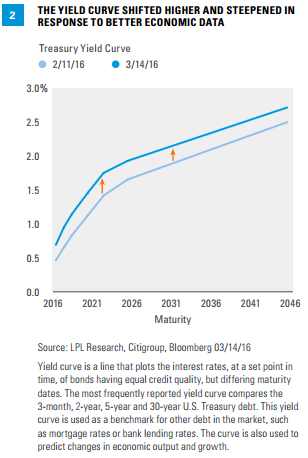

Now it is up to the Fed to support the pro-growth moves. In the U.S., bond markets have signaled more growth via a steeper yield curve since the midFebruary lows [Figure 2]. Improving economic data have been the biggest driver of the move, along with a reduction in investor pessimism. The 10-year Treasury yield has increased by 0.3% since then but remains lower by a still notable 0.3% year to date, suggesting investor psychology remains fragile amid global risks. The yield differential between the 2- and 10-year Treasury, another measure of yield curve slope, has increased in recent weeks; however, it remains not far off the narrowest (or flattest) levels of the past few years. There is still room for the Fed to have a positive impact.

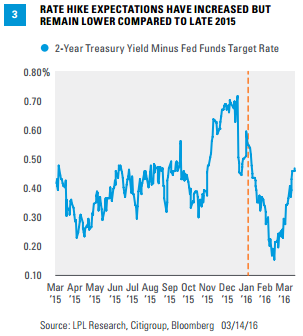

Market-implied Fed rate hike expectations have increased, as measured by the yield differential between the 2-year Treasury, among the most sensitive to Fed rate hikes, and the fed funds target rate set by the Fed [Figure 3]. The greater the yield differential, the more investors expect the Fed to raise interest rates. Rate hike expectations have increased in recent weeks but remain relatively benign. For all of 2016, only one rate hike is fully priced in according to fed fund futures and just two and a half rate hikes are priced in by the end of 2017. Bond investors expect the Fed to signal it is moving closer to these expectations.

CONCLUSION

Focus now shifts to the Fed possibly delivering a market-friendly message that will include a forecast of fewer rate hikes. It is unlikely the Fed will move all the way to market expectations, as it typically moves slowly. Nonetheless, failure to satisfy market expectations could undermine the rising pro-growth view and support Treasuries once again at the expense of lower-rated, more economically sensitive bonds like high-yield.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

High-yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

International debt securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical and regulatory risk, and risk associated with varying settlement standards. These risks are often heightened for investments in emerging markets.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-478240 (Exp. 03/17)