KEY TAKEAWAYS

- Sentiment from corporate America has deteriorated this quarter based on our Corporate Beige Book, but generally remains positive.

- Fourth quarter earnings results have painted a similar softer picture and have generally disappointed.

- We continue to expect earnings growth in the mid-single-digits in the second half of 2016.

Click here to download a PDF of this report.

CORPORATE BEIGE BOOK: MODEST DETERIORATION IN SENTIMENT

Our Corporate Beige Book highlights modest deterioration in corporate sentiment. Our analysis of the fourth quarter 2015 earnings period suggests that sentiment from corporate America did deteriorate from the prior quarter, but generally remains positive. And although actual fourth quarter 2015 earnings results have generally disappointed, we continue to believe earnings may be poised for a solid rebound during the second half of 2016.

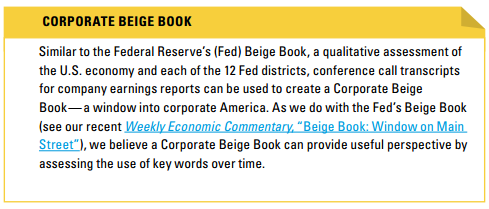

RECESSION BARELY ON THE RADAR

The biggest question in people’s minds right now is whether the U.S. economy is headed for a recession, which would almost certainly be accompanied by a bear market decline for the S&P 500. But that outcome is unlikely based on what we have heard from corporate management teams this earnings season. In fact, corporate America (and analysts on the conference calls) have not worried about a recession for quite a while now [Figure 1], with only between 5 and 12 mentions during the past five quarters (through six weeks of earnings reports). The lack of attention for the “R” word is partly a reflection of managements’ desire to convey optimism, but also likely reflects confidence in continued economic growth. We continue to place 30% odds on a recession in the next year, although market-based measures suggest those odds may be even higher.

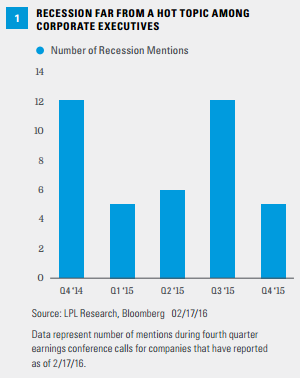

CHINA STILL A POPULAR TOPIC

China’s financial stability was one of the possible stock market catalysts we discussed here last week and remains a key concern for markets. The risk of a sharp yuan currency devaluation, or a dramatic slowdown in China’s economy (or both), has been reflected in the frequency of China mentions on earnings calls in recent quarters [Figure 2]. The 200 mentions during fourth quarter 2015 earnings season is down from the more than 300 mentions during the third quarter, which was shortly after China’s initial devaluation of its currency that led to the August 2015 U.S. stock market correction. Still, corporate management teams and analysts are maintaining their focus on Chinese business conditions, with China receiving many more mentions during the fourth quarter of 2015 than the first two quarters of the year.

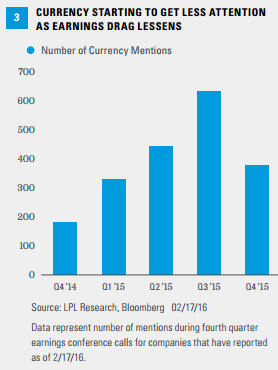

CURRENCY IMPACT BEGINNING TO FADE

The strong U.S. dollar has been a drag on earnings for over a year now and continues to get a lot of air time on earnings calls. (For more on the dollar, see the Weekly Economic Commentary, “From Headwind to Tailwind?”) The near 400 mentions during fourth quarter 2015 earnings season is roughly double the number from the year-ago quarter, although down from the prior two quarters [Figure 3]. Generally, the frequency of these mentions has lined up with the size of the dollar’s gains (bigger dollar gains lead to more mentions, and vice versa).

The good news is that the dollar will soon reach the one-year anniversary of its peak on March 13, 2015. If the dollar stays at its February 19, 2016 level for the rest of 2016, the year-over-year changes in the currency over the four quarters of 2016 would be approximately +3%, 0%, 0%, and -1%. These negligible impacts compare with the four quarters of 2015 when the dollar’s quarterly year-over-year changes tallied +18%, +20%, +17%, and +12%. S&P 500 companies in aggregate did not experience that full hit because only a portion of earnings are generated overseas in foreign currencies (estimated as slightly less than half) and many companies have currency hedging programs to mute the impact. Still, the S&P 500 does generally experience about one-third of that change, and the prospect of going from a 6-7% dollar drag on earnings in 2015 to potentially no impact in 2016 is noteworthy.

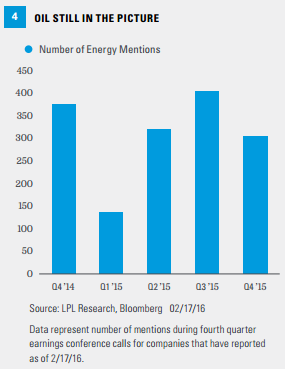

OIL NOT GOING AWAY QUIETLY

Low oil prices have kept the number of oil mentions (and related topics such as gas and fuel) during earnings calls elevated throughout recent quarters [Figure 4]. This is not particularly surprising, but we do find it interesting that the number of mentions dipped during the latest earnings reporting period, despite continued price weakness. It is difficult to point to another topic that took “share” from oil, suggesting the story may have sufficiently played out in the minds of management teams and analysts.

ENCOURAGING SENTIMENT READING

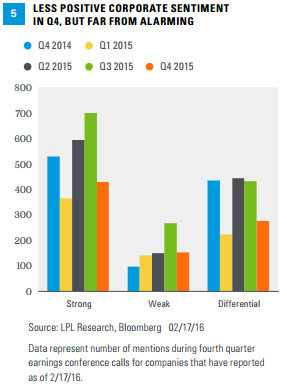

We also use earnings conference call transcripts to gauge overall corporate sentiment, much like we have done with the Fed’s Beige Book to create our Beige Book Barometer. To do this, we count the number of “strong” and “weak” words (or variations of these words) and calculate the difference between the two. Examples of strong words include “robust,” “solid,” and “optimistic”; examples of weak words include “weak,” “soft,” and “fragile.” We then measure that differential against prior quarters to make comparisons over time.

As shown in Figure 5, management sentiment was less positive during the fourth quarter of 2015 than it was in the prior quarter, based on the difference between the strong words and weak words used by management teams. Given jittery markets, this is also not a surprising result. A similar differential was observed during earnings season for the first quarter of 2015 (in April and May), when management teams were battling the weather-driven slowdown in economic activity.

We consider this result consistent with the increased macroeconomic risk and earnings softness we have witnessed in early 2016. But the picture is far from alarming, especially when considering the few mentions of a recession.

SIMILAR SOFTNESS SEEN IN ACTUAL RESULTS

The actual earnings results paint a similar softer picture. With 86% of S&P 500 companies having reported, Thomson-tracked S&P 500 earnings are tracking to a 3.8% year-over-year decline, virtually the same as the consensus expectation on January 1, 2016–a disappointing result given the typical upside of 3%. The biggest shortfalls have come from energy and financials, amid falling oil prices, financial market volatility, and the challenging interest rate environment. Even excluding energy (and its 75% earnings decline), earnings growth is on pace for just a 2% year-over-year increase, not enough to silence the media’s focus on an earnings recession. Revenue, which has also disappointed, is tracking to a 3.8% decline, compared with the consensus estimates for a 3.2% drop on January 1, 2016.

More disappointing is that these results put a potential 2016 earnings ramp-up in doubt (discussed in our Weekly Market Commentary, “Can Earnings Help?”). As of February 19, the consensus estimates for S&P 500 earnings in 2016 now call for just a 3% increase over 2015, compared with the nearly 8% increase as of January 1, 2016. Although much of the earnings softness is due to uncontrollable macro factors, especially oil, the dollar, low interest rates, and financial market volatility, the end result is that the market has pushed out forecasts for a resumption of earnings growth into the second half of 2016. The good news is, outside of energy, profit margins have remained resilient and the drag from the strong dollar may soon fade away. We still see solid second half gains as achievable, but global growth risks have risen and oil price stability remains elusive.

CONCLUSION

Sentiment from corporate America deteriorated in the fourth quarter, according to our Corporate Beige Book. Companies continue to face a challenging macroeconomic environment. Actual earnings and revenue results have disappointed, while expectations for an earnings ramp-up in 2016 have been pushed out. But sentiment is still generally positive, recession talk on earnings calls has been almost nonexistent, profit margins remain resilient, and the dollar has stabilized. We continue to expect earnings growth at least in the mid-single-digits for the S&P 500 during the second half of 2016, consistent with consensus estimates. Although the timing is difficult to predict amid continued macroeconomic uncertainty, we expect prospects for a late 2016 earnings ramp-up could act as a positive catalyst for stocks.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indexes are unmanaged and may not be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market.

All investing involves risk including loss of principal.

International investing involves special risks, such as currency fluctuation and political instability, and may not be suitable for all investors.

The fast price swings in commodities and currencies will results in significant volatility in an investor’s

holdings.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-470453 (Exp. 02/17)