KEY TAKEAWAYS

- The Fed’s decision to hike rates is a vote of confidence in the U.S. economy.

- We expect the likely gradual pace of rake hikes may provide support for stock valuations, and potentially provide some support for interest rate sensitive areas.

- We maintain our forecast for steady, but not spectacular, economic growth in 2016 and modest gains for stocks.

Click here to download a PDF of this report.

FINALLY

Finally! For the first time in nine years, the Fed finally raised interest rates. On Wednesday, December 16, 2015, the Federal Open Market Committee (FOMC), the monetary policymaking arm of the Federal Reserve (Fed), initiated a Fed policy tightening cycle for the first time in more than 11 years by raising the target for the federal funds rate by 0.25% (the rate that banks charge each other for overnight loans on funds held at the Fed). The widely expected decision marks the end of a long, seven-year period of zero rates initiated by the Fed to combat the effects of the financial crisis in 2008. This is a big event (maybe not Star Wars big, but big) because of how long zero rates have been in place.

Here we share some thoughts on what the Fed move may mean for stocks. Today’s Weekly Economic Commentary,“The Wait Is Over,” discusses the economic impact of the Fed decision, focusing on the potential impact on the housing sector.

VOTE OF CONFIDENCE

The Fed’s decision should be viewed as a vote of confidence. The Fed hiked rates because it believes the economy is strong enough to stand on its own and is likely to continue to grow without the added support of near zero interest rates. Fed Chair Janet Yellen said it herself in her December 16 press conference after the decision: “The Fed’s decision today reflects our confidence in the U.S. economy.” We saw the alternative in September when the Fed surprised markets by not raising rates, citing risks overseas, and stocks fell because market participants wondered what the Fed knew that they didn’t. Thus, although the beginning of a rate hike cycle does feel unusual, because it has been such a long time, it means that we are returning to a more typical economic environment.

Rate hikes also reaffirm that we have passed the midpoint of the economic cycle, a stage that may bring additional market volatility. We especially anticipate it in the coming weeks and months, as investors adjust to the start of a new era of U.S. monetary policy. Historically, while stocks have risen in the year after the Fed starts hiking rates, performance has been mixed during the first three months.

GRADUAL PACE

The FOMC put the word “gradual” in its statement twice and Chair Yellen uttered the word in her press conference a total of 15 times. We have long stated that the pace of subsequent rate hikes is more important than the timing of the first one, a stance the Fed seems to share. The Fed has been very cautious since the financial crisis and we expect it to continue to err on the side of caution. A slow path for further increases would give the economy time to adjust.

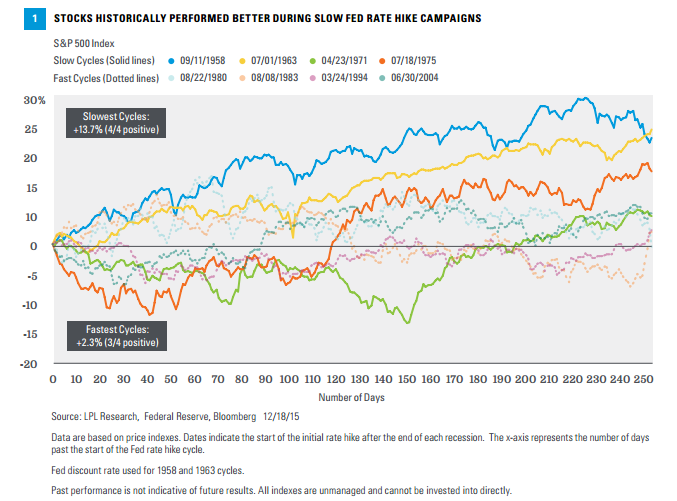

Although the market has only seen steady tightening cycles in recent decades, in the 1950s, 1960s, and even in the early 1970s, we saw slower cycles of rate hikes (note that rate hikes were tied to money supply in the 1980s). Stocks fared better during these periods than they did after the start of rate hike campaigns in 1994 and 2004 when the Fed hiked rates following every meeting [Figure 1]. Chair Yellen is trying to avoid raising rates too slowly, creating the need for “catch-up” later that could spook markets, noting in her press conference after the Fed’s announcement: “What we would like to avoid is a situation where we have waited so long that we are forced to tighten policy abruptly, which risks aborting what I would like to see as a very long running and sustainable expansion.”

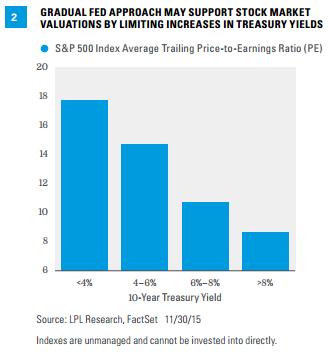

A gradual pace of rate hikes should help support stock market valuations. Stock valuations are partly a function of market interest rates [Figure 2], which are partly a function of the level and trajectory of the federal funds rate controlled by the Fed (growth and inflation also play key roles). Interest rates reflect the level of competition bonds provide for stocks, and a gradual pace of hikes suggests that the weak competitive threat bonds currently present for stocks is unlikely to get much stronger anytime soon.

Low interest rates overseas should also help keep U.S. bond yields from moving significantly higher and support U.S. stock valuations. Foreign investors continue to find U.S. Treasuries relatively more attractive than the local counterparts, where yields are being held down by bond purchase programs from the European and Japanese central banks.

ASSET ALLOCATION PERSPECTIVES

The start of monetary policy normalization, fully anticipated, does not change our stock market outlook–we continue to expect mid-single-digit gains for the S&P 500 (based on total returns) in 2016* and will hopefully eke out a couple more points over the remaining weeks of 2015. We continue to favor stocks over bonds, large caps over small, growth over value, and, for now, domestic over foreign with our equity allocations. Healthcare, industrials, and technology remain our favorite sectors.

*Historically since WWII, the average annual gain on stocks has been 7-9%.Thus, our forecast is in-line with average stock market growth. We forecast a mid-single-digit gain, including dividends, for U.S. stocks in 2016 as measured by the S&P 500. This gain is derived from earnings per share (EPS) for S&P 500 companies assuming mid- to high-single-digit earnings gains, and a largely stable price-to-earnings ratio (PE). Earnings gains are supported by our expectation of improved global economic growth and stable profit margins in 2016.

However, the go-slow approach to hikes that we expect from the Fed will, on the margin, be helpful to the interest rate sensitive areas of the equity market:

- Real estate investment trusts (REIT). REITs have several positive attributes. First, interest rates remain low. The 10-year Treasury settled Friday, December 18, 2015, at a yield of just 2.20% even after the Fed rate hike, making REIT yields relatively more attractive. Second, the U.S. economic backdrop for REITs (hiring trends, low unemployment rate, etc.) is generally favorable. Third, we have not seen the type of overbuilding we saw in past real estate booms, suggesting a reasonable supply-demand balance. Add to that the likely gradual pace of future rate hikes and REITs become more appealing for suitable income-oriented investors. Still, our tactical view (which has no bias for income) remains neutral, although we could envision becoming more positive if rising interest rates create an attractive buying opportunity.

- Master limited partnerships (MLP). MLPs have largely disconnected from interest rates due to the significant drop in oil prices and news that some pipeline companies had reduced distributions. Until oil prices stabilize and investors get more clarity on the distribution outlook, we would not expect this group to be as responsive to changes in interest rates as it has been historically. As a result, we see only a marginal near-term benefit from a likely gradual pace of rate hikes.

- Utilities. The utilities sector exhibits a high degree of interest rate sensitivity and is used by some investors as a bond substitute. We continue to favor more economically sensitive sectors due to our macroeconomic outlook, but low yields from bond market alternatives and the likely modest rise in yields due to the gradual pace of Fed tightening may help this group hold up relatively well, despite rich valuations.

Though commodities are not traditionally considered interest rate sensitive, they may also be positively impacted. A gradual pace of tightening may limit further upward pressure on the U.S. dollar, which may help speed up the commodities bottoming process. Oil has become critically important for financial markets, impacting corporate profits, capital spending, emerging market economies, and credit markets.

One interest rate sensitive area of the equity market that may not be helped much is banks. A gradual pace of rate hikes could mean short-term rates rise more than longer-term rates (a flattening of the yield curve), which may limit the benefit to traditional banks. This happened last week after the Fed announcement, which led to underperformance by the banks on prospects for narrower net interest margins, the difference between banks’ cost of funds and the rates

on loans.

CONCLUSION

The Fed’s decision to hike rates is a vote of confidence in the U.S. economy. The Fed hiked rates because it believes the economy is strong enough to stand on its own. We expect the likely gradual pace of rate hikes may provide support for stock valuations, and potentially provide some support for some interest rate sensitive areas. While the decision does suggest that the economy has passed the midpoint of the business cycle, which may bring volatility, it does not change our forecast for steady, but not spectacular, economic growth in 2016 and modest gains for stocks.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in real estate/REITs involves special risks, such as potential illiquidity, and may not be suitable for all investors. There is no assurance that the investment objectives of this program will be attained.

Investing in MLPs involves a high degree of risk including risks related to cash flow, dilution and voting rights. MLPs may trade less frequently than larger companies due to their smaller capitalizations which may result in erratic price movement or difficulty in buying or selling. MLPs are subject to significant regulation and may be adversely affected by changes in the regulatory environment including the risk that an MLP could lose its tax status as a partnership. Additionally high management fees and other expenses are associated with investing in MLP funds.

Because of its narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets as well as weather, disease, and regulatory developments.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Trailing PE is the sum of a company’s price-to-earnings, calculated by taking the current stock price and dividing it by the trailing earnings per share for the past 12 months. This measure differs from forward PE, which uses earnings estimates for the next four quarters.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market.

All investing involves risk including loss of principal.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-450497 (Exp. 12/16)