KEY TAKEAWAYS

- The OPEC December meeting will be the most important meeting in years.

- No major changes to policy are expected.

- There are significant differences within OPEC, but Saudi Arabia will still dictate policy.

Click here to download a PDF of this report.

OPEC’S DECEMBER 2015 MEETING: RELEVANT OR JUST LOST IN THE DESERT?

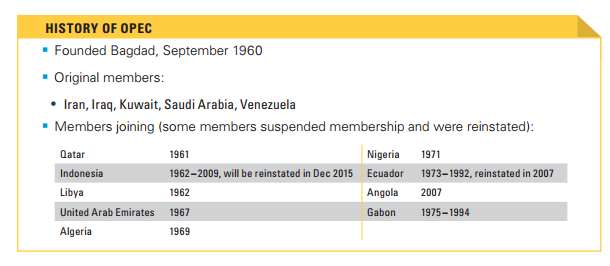

The Organization of Petroleum Exporting Countries (OPEC) will have its 168th meeting at its headquarters in Vienna, Austria on December 4, 2015. The primary goal at this meeting is to set production quotas for each member country, adjusting supply and thereby influencing global oil prices. OPEC does not directly set or maintain target crude oil prices. It is also widely acknowledged that countries have a tendency to cheat–producing over their quota in order to generate more revenue. Few, if any, changes to the current production quotas are expected at this meeting.

CHANGING ROLE OF OPEC

OPEC’s importance has declined from its heights in the 1970s, but OPEC countries still collectively produce 40% of the world’s oil and 60% of the oil that is shipped internationally.

Thus far, OPEC has not responded to the decline in crude oil prices by cutting production quotas. Such cuts were expressly rejected at the last formal meeting on June 5, 2015. A “technical meeting” took place on October 21, 2015, with a number of OPEC and non-OPEC energy producers. At that meeting, an increasing economically desperate Venezuela advocated OPEC return to its 1980s policy of targeting oil prices directly, calling for an immediate rise in prices to $88 per barrel. The proposal received limited support, only from Ecuador and Algeria, suggesting how difficult it will be to move from the status quo.

DECEMBER MEETING: WHAT IS THE END GAME?

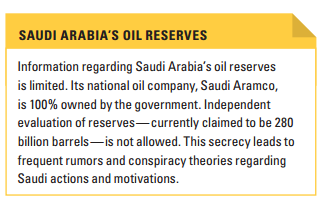

Though OPEC is a singular entity, it has a diverse membership with different needs and agendas. Saudi Arabia has always been the dominant force within OPEC, based on what is believed its high level of reserves and low cost of extraction.

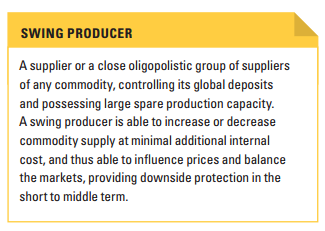

Saudi Arabia has maintained a hard line, stating that the global supply imbalance must be corrected by production cuts from non-OPEC producers. Led by Saudi Arabia, OPEC’s resistance to production cuts has contributed to the current global oil glut and low prices. This has been referred to as protecting “market share,” but from whom? Saudi Arabia does seem to be protecting its status as “swing producer” (see sidebar on page 4) for oil.

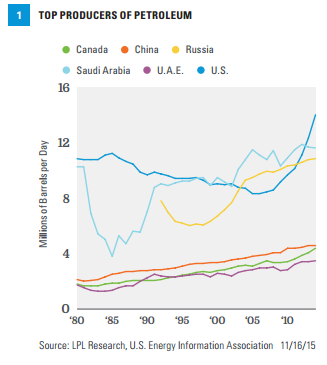

Figure 1 shows the changes in global oil production, detailing the extent to which the United States has become a factor in the oil price equation. There is no way to know which are most important to the Saudis, but some factors clearly on their mind include:

- North America. Driven largely by new technologies, the production of shale, tar sands, and other unconventional sources may present a short-term challenge to Saudi dominance. However, some believe that the relatively high extraction and transportation costs may limit North American production over time.

- Russia. Saudi Arabia battles Russia not only for sale of oil, but for influence in Islamic regions within the Russian federations and geopolitical influence among the former Soviet republics and across the wider region.

- Iran. In many ways Iran is Saudi’s natural rival. Both countries are Islamic, but Iran is largely Shia, while the Saudi’s follow the strict Wahhabi sect of Sunni Islam. Furthermore, though Iran is Islamic, its ethnic heritage is Persian, not Arab.

- Smaller producers. Saudi Arabia may have no particular agenda with respect to smaller OPEC producers, such as Venezuela and Ecuador, but historically these countries followed their lead with little or no need for further actions. The Saudis cannot be pleased that the cartel’s junior members are questioning their policies.

All reports prior to the upcoming December 4, 2015, OPEC meeting suggest that there will be no change in policy. This has been said by Saudi officials for some time, and was recently repeated by the oil minister of OPEC member United Arab Emirates (U.A.E.). The weakness in oil prices in November 2015 can be at least partially attributed to the market absorbing this news. There is some chance that OPEC might announce insignificant cuts in production or make some other technical concession to allow Saudi Arabia, the U.A.E., and the other OPEC leaders to appear magnanimous. However, any change should be viewed as related to harmony within OPEC, not a fundamental shift.

HOW MUCH LONGER CAN PRICES STAY THIS LOW?

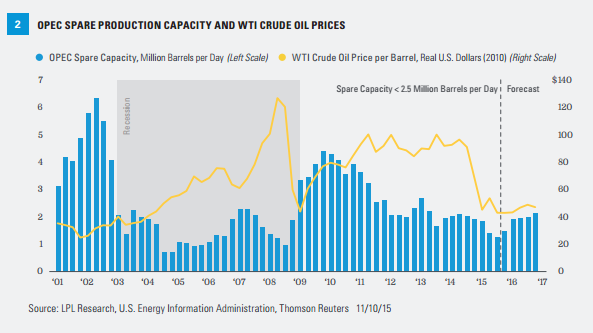

Fundamental analysis suggests that oil prices may remain relatively low in the near term; and while prices likely will rise next year, any appreciation may be subdued. Figure 2 shows how sharply prices can move when excess capacity among oil producers is tight. But that is not the case today; it is believed that production can come on and offline quickly depending on market prices.

The real question is not what will happen in December, but how long can the Saudis maintain such a hard line. All countries have a limited supply of oil; every barrel sold today at a low price is a barrel that cannot be sold next year potentially at a higher price. Countries like Saudi Arabia, Kuwait, and the U.A.E., with large reserves and lower extraction costs, are best positioned for this environment. Lower oil prices are hurting all of Saudi Arabia’s rivals, either by driving production off-line or by reducing revenue to their rivals.

WHAT PRICE IS TOO LOW FOR SAUDI ARABIA?

Saudi Arabia is not immune from the pain low oil prices are causing. Despite some attempts to diversify, the Saudi economy is highly dependent on the government redistributing oil wealth, which accounts for 80% of the Saudi budget on social programs. This summer the country borrowed $4 billion–its first government bond issue since 2007–to cover its budget deficits, and plans to borrow as much as $27 billion. These are not huge numbers in the grand scheme of the global economy, but have already resulted in the country being downgraded (though still considered investment grade) by the credit agencies since repaying these debts is dependent on higher oil prices. Further borrowing may also raise the ire of some Islamic hardliners, who believe that the use of debt instruments violate the Sharia prohibitions against the usury.

Ultimately, we know the prices for oil must go higher; at under $50 per barrel, too much production falls below the total extraction costs. Production cuts, which have already started in North America, are expected to deepen and extend to other high production cost regions. This will inevitably lead to rising prices as supply and demand balance out. The price of oil has frequently been subject to non-economic influence as oil can be a tool, or a weapon, of many countries’ foreign policy. This creates a level of uncertainty in the market. In our view, that uncertainty today is abnormally high, even as the price of oil is abnormally low.

CONCLUSION

The consensus view for next year is that prices will average in the mid-$50s for the year, likely ending 2016 around $60. This is well above current prices but still below the average prices for the past few years. The underlying assumption is that OPEC will not materially change policy either in December or at their meeting in June 2016 and that non-OPEC sources will continue to cut production begrudgingly. While this is the most probable outcome, the government of Saudi Arabia is under pressure internally and from its OPEC partners to act sooner and more decisively to get prices higher. How they deal with this pressure will likely be the most important factor in oil prices next year.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted.

OPEC is an organization consisting of the world’s major oil-exporting nations. The Organization of Petroleum Exporting Countries (OPEC) was founded in 1960 to coordinate the petroleum policies of its members, and to provide member states with technical and economic aid. OPEC is a cartel that aims to manage the supply of oil in an effort to set the price of oil on the world market, in order to avoid fluctuations that might affect the economies of both producing and purchasing countries.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond and bond mutual fund values and yields will decline as interest rates rise and bonds are subject to availability and change in price.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets as well as weather, geopolitical events, and regulatory developments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-443014 (Exp. 11/16)