KEY TAKEAWAYS

- October was a great month for stocks, but it does raise the bar for markets to add to gains over the rest of the year.

- Although more volatility may come, we see several potential catalysts, including the Fed, jobs reports, OPEC, and holiday retail sales, that may help stocks add to year-to-date gains.

Click here to download a PDF of this report.

A LOOK AHEAD

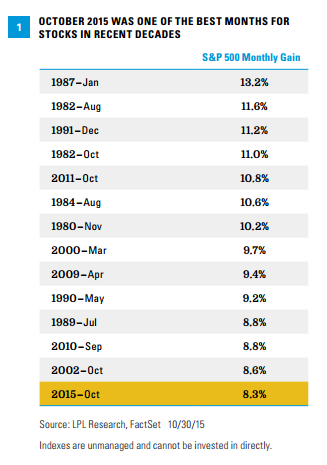

You have to really hunt to find red in October. October 2015 was a great month for stocks, as the S&P 500 Index rose 8.3% to help take the index from a year-to-date loss of over 9% on August 25, 2015, to a 1% gain as of Friday, October 30, 2015. Only 13 months since 1980 have been better, including only 3 Octobers [Figure 1]. The old market adage that October is the month where bear markets go to die held true. But the strong month raises the bar for markets to add to gains over the rest of the year, as higher stock prices have brought higher valuations. It is

interesting to note that nearly all of these strong months came during the early or middle parts of bull markets, with March 2000 being the one notable exception. We look ahead at the calendar to identify catalysts that could potentially help stocks add to recent gains.

QUITE A MONTH

We believe October’s gains were driven primarily by two factors: the market’s increased comfort with China and market-friendly central bank actions. A relatively good start to earnings season and the budget deal in Washington to stave off a nasty debt ceiling debate also helped buoy sentiment.

China’s economy is likely growing more slowly than the official gross domestic product (GDP) statistics, although the reliable Chinese data we have suggest growth is stabilizing. The sixth interest rate cut in the past year by the People’s Bank of China (China’s central bank) and other stimulus initiatives have added to the market’s confidence that China would avoid a hard landing (see our latest Thought Leadership piece on China).

Central bank activities in the U.S. and Europe also helped drive stocks higher in October. In the U.S. for much of October, stocks benefited from the pushout of market expectations for Federal Reserve (Fed) rate hikes into early 2016. Stocks held their monthly gains after the Fed removed the portion of its policy statement about overseas growth concerns, even though the odds of a December rate hike increased (based on fed fund futures). Optimism about more stimulus from the European Central Bank (ECB) also helped boost U.S. stocks in late October.

Just because October was a big month does not necessarily mean that stocks will pull back between now and the end of the year. Since 1980, the S&P 500 has been up an average of 1.2% with gains 50% of the time in the two months following a calendar month gain of over 8%. That small potential gain, coupled with dividends, could potentially get the S&P 500 to the low end of our 5-9% total return forecast for 2015.

CATALYST CALENDAR

There are some potential events on the calendar that may be key determining factors of whether stocks can add to 2015 gains over the next two months.

Federal Open Market Committee (FOMC) meeting (December 15-16). We see this date as a potential catalyst because of the strong performance record stocks have historically experienced after the Fed begins to hike rates.* The market may like getting the first hike out of the way, especially considering the implied positive growth message. That said, we recognize that the first Fed rate hike of an economic cycle has driven stock market volatility in the past (though usually short lived), so this date is a risk as much as a potential catalyst.

*Examining the 9 initial rate hikes after the end of each recession since the end of WWII, the S&P 500 moved higher 5 out of 9 times 3 months after an initial rate hike, and 7 out 9 times over the following 6 months after a first Fed rate hike, with an average return of 4.2%.

Also worth noting, Fed Chair Janet Yellen will speak on November 4, 2015, before the Financial Services Committee of the U.S. House of Representatives, and before the Economic Club of Washington on December 2, 2015. Fed Vice Chair Stanley Fischer will speak to the Economic Club of Washington on November 4, 2015. These events may provide insights into the path of future Fed policy and could act as secondary catalysts.

Jobs reports (November 6, December 4). We believe the Fed is still very much on the fence about whether to hike rates in December or to wait until early 2016 (see today’s Weekly Economic Commentary for more). The two jobs reports will go a long way toward determining whether the Fed hikes rates at its next meeting in December. Recall the September jobs report was soft, with just 142,000 net new jobs created for the month (below the 2015 trend of around 200,000), although the unemployment rate held steady

at 5.1%.

OPEC meeting (December 4). OPEC will hold its biannual meeting on December 4. Oil has become more important for financial markets, as the drop in oil prices has significantly impacted overall corporate profits, capital spending, emerging market economies, and credit markets. While the status quo is the most likely scenario, it is possible that stocks may get some help from a reduction in OPEC’s production target and a subsequent bump up in oil. Saudi Arabia is in control and seems intent on preserving market share, but could try to talk up prices to help the smaller players without meaningfully altering its own production.

Holiday retail sales (December 11). The government’s retail sales data for November, to be released on December 11, include the first month of the all-important holiday shopping season. For many retailers and tech gadget makers, more than half of their sales for the year come during the peak holiday shopping season (November and December). The consumer has been the key driver of U.S. economic growth - consumer spending rose at a 3.2% annualized pace during the third quarter, compared to overall GDP growth of just 1.5%. Based on recent sales trends and strong consumer balance sheets, we expect holiday shopping sales totals to grow roughly in-line with the National Retail Federation’s forecast of 3.7% in 2015. Holiday shopping may not be a big potential positive catalyst, but we do not expect it to be a drag either.

WASHINGTON OFF THE CALENDAR

One potential catalyst - either positive or negative - that is not on the calendar for the rest of 2015 is Washington. A two-year budget deal has been passed by both the House and Senate and will be signed into law by the President this week. The agreement has eliminated the possibility of another nasty debt ceiling fight like Washington put us through in 2011 and again in 2013. The lack of significant Washington dates on the calendar, besides a spending bill due in December to appropriate the funds from the budget deal, is a positive for markets near term.

DON’T FORGET THE SEASONAL TAILWIND

Though not a specific date upcoming on the calendar, the fact that the month of November has begun may be helpful for stocks for the rest of the year. Historically, the stock market has done better between November 1 and April 30 (thus the adage, “sell in May”). Based on S&P 500 data back to 1950, stocks are up an average of 7% between November and April, and are up just 1% on average during the other six months. Every year is different, but

we do acknowledge this pattern has repeated itself enough to warrant some attention.

CONCLUSION

October was a good month for stocks; however, this does not rule out potential further gains this year. Although more volatility may come, we see some catalysts that could potentially help stocks add to gains between now and the end of the year. We believe the Fed, jobs reports, OPEC, and holiday retail sales figures will go a long way toward determining whether stocks may end the year higher than current levels. Some quiet on Capitol Hill and a seasonal tailwind may also help.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market.

Because of its narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

DEFINITIONS

Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

OPEC is an organization consisting of the world’s major oil-exporting nations. The Organization of Petroleum Exporting Countries (OPEC) was founded in 1960 to coordinate the petroleum policies of its members, and to provide member states with technical and economic aid. OPEC is a cartel that aims to manage the supply of oil in an effort to set the price of oil on the world market, in order to avoid fluctuations that might affect the economies of both producing and purchasing countries.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-436703 (Exp. 11/16)