KEY TAKEAWAYS

- High-quality U.S. bonds continue to feel the push and pull of global central banks.

- This week’s FOMC meeting is largely expected to be a non-event, but the post-meeting statement will be important.

- Until a conclusive change from central banks arises, the low-return, range-bound environment will likely persist in the bond market.

Click here to download a PDF of this report.

CENTRAL BANK TUG-OF-WAR

As the Federal Reserve (Fed) inches closer to an eventual rate increase, the majority of global central banks are taking the opposite tack and cutting rates or easing policy. High-quality U.S. bonds continue to feel the push and pull of global central banks. Last week both the European Central Bank (ECB) and People’s Bank of China (PBOC) suggested or announced market-friendly measures that boosted stocks at the expense of mild Treasury weakness. The ECB hinted strongly that bond purchases may be expanded and interest rates may be cut into negative territory, while the PBOC announced its fifth rate cut and additional easing measures. Both moves intend to spur better economic growth. This week it’s the Fed’s turn, but the Federal Open Market Committee (FOMC) meeting is not expected to result in any substantial shift in policy.

MIXED BAG

Central bank actions can have a mixed impact on bond markets. The PBOC’s action was viewed as necessary and a relief to help offset further deceleration in China’s economy; while the ECB hinted at more, cutting bank borrowing rates further into negative territory, and/or expanding ongoing bond purchases. Both types of stimulus–or in the case of the ECB, hinting at stimulus–helped boost economic growth expectations. In response, longer-term bond yields generally increased.

Short-term interest rates are most directly impacted by central bank actions and yield declines were fairly sharp across Europe as a result of the ECB rhetoric. A total of 13 European countries now offer negative government bond yields on maturities up to two years, up from nine countries during the first quarter of 2015. Two-year yields in an additional five countries are below 0.2%. In Switzerland, an investor must look beyond 12-year bonds to find a positive yielding government bond. Another rate cut from the ECB could help anchor short-term bond yields at very low levels, and the hint of such aggressive policy helped lower intermediate- to longer-term yields across Europe.

More economically sensitive, or lower-rated, bond issuers were among the biggest beneficiaries of ECB rhetoric. Bond prices increased most in Italy and Spain, and European high-yield issuers also benefited. In conjunction with the PBOC rate cut, U.S. high-yield bond prices also improved, although gains were limited by weaker oil prices.

In the U.S., yields increased across the maturity spectrum but for different reasons. Short-term Treasury yields moved higher in anticipation of a first Fed rate hike perhaps coming sooner, as economic growth prospects improve based upon easing by the PBOC and the prospect of additional easing from the ECB. Longer-term 10- and 30-year Treasury yields also moved higher, but more in response to better economic growth and higher inflation that may result from central banks lowering rates.

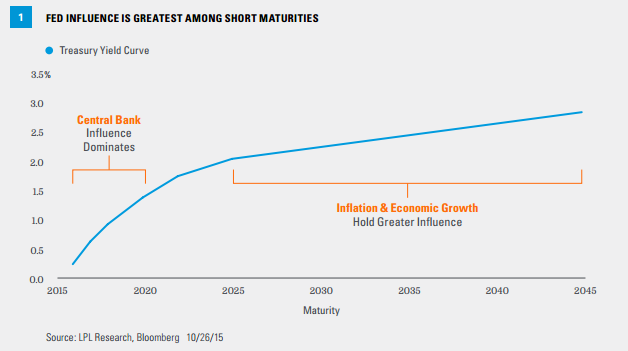

A view of the current Treasury yield indicates which factors have greater influence over which parts of the yield curve [Figure 1]. Short-term notes and maturities out to 5 years are typically more influenced by where the Fed sets the fed funds target rate, while longer 10- and 30-year maturities are influenced more by growth and inflation. That is not to say the Fed cannot influence longer-term yields. An upward-sloping yield curve reflects the belief that central bank medicine (low rates) will work over time. The Fed can also influence longer-term yields by indicating the potential pace and magnitude of potential interest rate changes, as well as via opinions of the state of the U.S. economy and inflation.

Therein lies the push and pull on Treasury yields. A potential slow pace of rate hikes in the U.S. is likely to push up longer-term yields only gradually, especially considering the headwinds of weaker global growth and central banks that continue to step on the gas in order to perk up their economies.

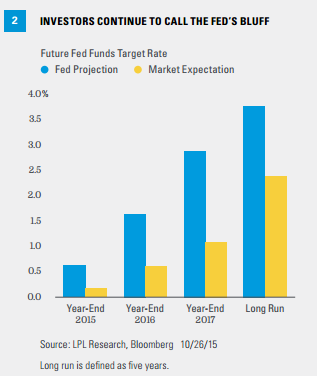

Market expectations, therefore, continue to push against the Fed’s projected path of raising interest rates [Figure 2]. Fed fund futures continue to show a much more benign pace of rate hikes relative to the Fed’s latest forecasts released at the conclusion of the meeting on September 17, 2015. Over the past year the Fed’s forecasts have moved closer to market expectations and may do so again at the conclusion of the December meeting when a new set of forecasts will be released.

However, this week’s meeting contains only a statement release with no press conference or updated forecasts. The Fed meeting is likely to be a non-event, although investors will focus on mentions of China, low inflation, labor markets, and wages as a guide to the latest Fed thinking. Since the September meeting, little has changed, with inflation expectations low and domestic economic data mixed. The Fed will not even have the benefit of another employment report after a disappointing September payrolls report released in early October, and is not likely to voice a strong opinion one way or another in the statement that accompanies the conclusion of this week’s meeting.

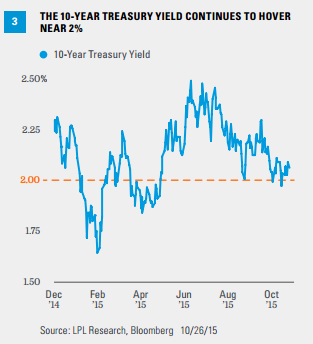

Nonetheless, Figure 2 also illustrates that a lot of good news about the Fed is already factored into current Treasury prices and yields. This is one reason why the 10-year Treasury yield has stalled around 2% [Figure 3], leaving the market waiting for a conclusive change from central banks either domestically or globally. Until that conclusive change arises, most likely in the form of improved economic data, the low-return, range-bound environment is likely to persist in the bond market.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-434312 (Exp. 10/16)