KEY TAKEAWAYS

- Treasury yields have declined despite diminishing demand from overseas investors

- A lack of foreign demand may produce headwinds, but will take a backseat to Fed policy, economic growth, and inflation rates as drivers of bond yields.

Click here to download a PDF of this report.

FOREIGN DEMAND WEAKENS

Foreign investors’ interest in U.S. Treasuries has faded in recent months, yet bond market impacts have been extremely limited. The latest round of data on foreign holdings of U.S. Treasuries revealed another decline. The Treasury International Capital System (TICS) data showed that foreign Treasury holdings fell by $17 billion during August 2015, from a combination of outright selling and maturing bonds, the third straight monthly decline. Foreign central banks sold Treasuries for the 11th consecutive month. Currency devaluation (most notably by China in August) and the fact that 47% of U.S. Treasuries are held by foreigners make recent foreign holdings data of regular interest to investors.

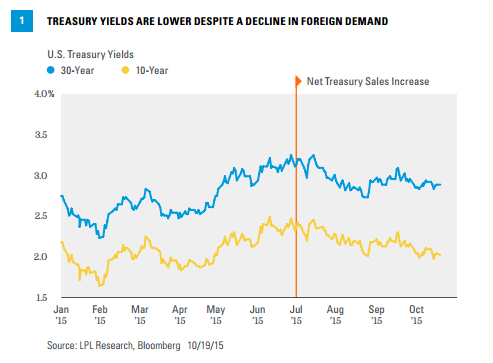

Intermediate- to longer-term Treasury prices rose and yields declined in recent months, despite lackluster foreign demand [Figure 1]. The dividing line of Figure 1 highlights the period when Treasury selling began to increase. Fears that a decline in foreign demand would lead to sharply higher bond yields have once again proven misguided.

Investor focus on economic growth, inflation, and Federal Reserve (Fed) policy remain the main drivers of bond yields, as has been historically the case. Low inflation, with limited signs of wage pressures, and a delay in the anticipated start of Fed rate hikes helped drive Treasury prices mostly higher from early July through early October 2015. Investors, and the Fed, remain on alert for how much a slowdown in global economic growth may impact the U.S. economy, if at all, and thus maintain downward pressure on bond yields.

The impact of a modest decline in foreign buying has been limited so far. In August 2015, Treasury yields showed limited response to a decline in stock prices. From August 18 through August 25, 2015, stocks declined by just over 11%,* while the 10-year Treasury yield declined by only 0.12%. Part of the stickiness of Treasury yields during that period was driven by foreign central bank selling of Treasuries, with China the most notable. Weakness in some emerging market currencies sparked Treasury sales in an effort to slow the pace of decline.

*As measured by the S&P 500 Index.

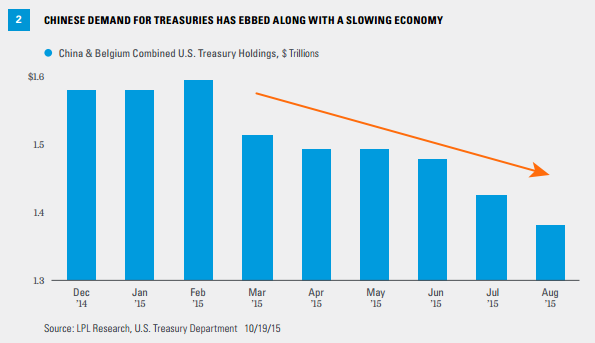

China, the largest foreign holder of Treasury notes and bonds, marginally increased Treasury holdings in August; however, this hides potential sales done via custodial accounts in Belgium. A recent Fed report discussed the presence of Chinese custodial accounts in Belgium as accounting for China’s Treasury sales. A relatively high proportion of Treasury holdings and wild monthly swings indicated Belgium’s holdings were suspect. Combining China and Belgium holdings reported in the TICS data reveals a steady decline in China’s holdings that is commensurate with a slowdown in the Chinese economy and corresponding renminbi devaluation in August [Figure 2]. Weaker Chinese economic growth, and weaker exports in particular, lessen the need for China to buy Treasuries, and the August currency devaluation was an opportunity to sell.

Overall, foreign holdings of U.S. Treasuries have declined by a scant 1% year to date through the end of August 2015, and more timely data on foreign holdings held in custody at the New York Federal Reserve show overall holdings are little changed since the end of August.

We do not view the activity in recent months as precursor to an acceleration in foreign sales of Treasuries. Large scale, and steady, liquidations are unlikely in our view. Such action would be counterproductive as massive sales could merely bring lower prices and reduce the value of remaining bond holdings.

Foreign demand also fluctuates over time in response to a variety of factors, including safe-haven buying, fluctuating trade flows, changes in a country’s foreign exchange reserves, and international currency fluctuations. Renewed U.S. dollar strength during the third quarter of 2015 may have been a catalyst for sales as well.

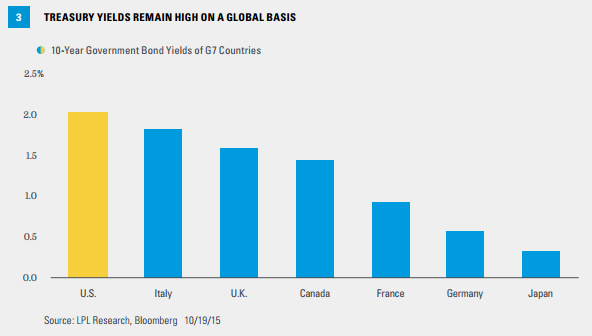

At the same time, foreign investors also continue to buy and recent auction results show demand by foreign investors. U.S. Treasuries remain the deepest, most liquid government bond market in the world and still offer higher yields than most developed foreign country counterparts [Figure 3]. In addition to yield, the fact that the Fed remains closer to raising interest rates than most other global central banks may keep yields elevated on a global basis and also supports U.S. dollar strength–both attributes that may support future investment.

Weaker foreign demand has not led to higher Treasury yields and burdensome interest rates for the U.S. economy. On the contrary, Treasury yields and consumer interest rates tied to the bond market have declined in recent months. Massive liquidations are unlikely and Treasuries remain the largest, most liquid bond market in the world.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

Currency risk is a form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-431942 (Exp. 10/16)