KEY TAKEAWAYS

- The latest Beige Book suggests that the U.S. economy is still growing at its long-term trend.

- However, the latest assessment from Main Street suggests that the manufacturing sector is being impacted by drags from the stronger dollar, weaker oil and energy prices, and the slowdown in EM economies.

- Optimism regarding the economic outlook far outweighed pessimism throughout the Beige Book once.

Click here to download a PDF of this report.

BEIGE BOOK: WINDOW ON MAIN STREET

BEIGE BOOK SUGGESTS CONTINUED MODEST ECONOMIC GROWTH

The latest Beige Book suggests that the U.S. economy is still growing at its long-term trend, but that the drag from a stronger dollar, weaker oil and energy prices, along with the slowdown in emerging market (EM) economies–most notably China–are still having a major impact on the manufacturing sector. The comments in the Beige Book also continue to indicate that some upward pressure on wages is beginning to emerge. Overall, the Beige Book described the economy as expanding at a “modest or moderate” pace in most districts. In general, optimism regarding the economic outlook far outweighed pessimism throughout the Beige Book, as it has for the past two years or so.

The Beige Book is a qualitative assessment of the U.S. economy and each of the 12 Federal Reserve (Fed) districts. We believe the Beige Book is best interpreted quantitatively by measuring how the descriptors change over time. The latest edition of the Fed’s Beige Book was released Wednesday, October 14, 2015, ahead of the October 27-28 Federal Open Market Committee (FOMC) meeting. The qualitative inputs for the October 2015 Beige Book were collected from late August 2015 through October 5, 2015. Thus, they captured the Main Street reaction to:

- The first 10%-plus correction in the U.S. equity market since 2011

- Economic and inflation data for July, August, and September 2015 that were generally softer than expected, especially in the manufacturing sector

- A 20% bounce in oil prices following a quick 30% drop in July and August

- Heightened fears of a “hard landing” in the Chinese economy

SENTIMENT SNAPSHOT

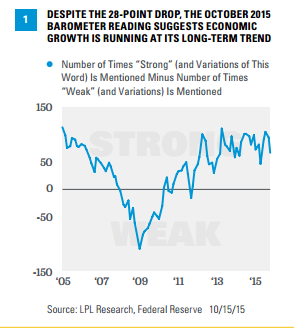

To provide a snapshot of the sentiment behind the entire Beige Book collage of data, we created our proprietary Beige Book Barometer (BBB) [Figure 1]. In October 2015, the barometer ticked down to +67 from +95 in September. Roughly half of the 28-point drop came in the three Fed districts (Minneapolis, Kansas City, and Dallas) with the most oil and gas activity. Recall that the +106 reading in July 2015 was the highest reading since April 2013, and the second-highest reading in over 10 years. While a downshift from the past few Beige Books, the +67 reading in October 2015, if sustained, suggests economic growth is running at its long-term trend, and does not indicate that an economy-wide recession is at hand.

WATCHING WAGES & INFLATION

As it has over the past year, the October 2015 Beige Book noted that employers were having difficulty finding qualified workers for certain skilled positions and some reported upward wage pressures for particular industries and occupations. In the past, these characterizations of labor markets have been a precursor to more prevalent economy-wide wage increases. Indeed, for the first time in this business cycle, Beige Books released over the past 12 months contained several mentions of employers having difficulty attracting and retaining low-skilled workers, and retaining and compensating key workers.

If this trend persists over the next few Beige Books, history suggests it may not be long until Fed policymakers begin to take note of a faster pace of wage inflation in their monetary policy deliberations. However, the Beige Book would likely have to describe wage gains as “widespread” before the Fed would have to act. If the trend toward more inflation signaling words in the Beige Book persists but the economic data remain weak, at some point the Fed may still believe it needs to raise rates to stave off inflation. This is not a concern yet, but something we are watching closely.

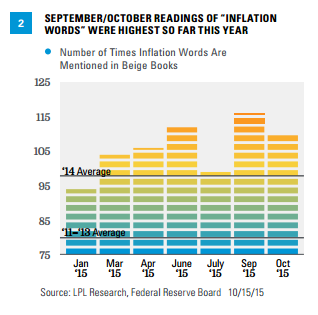

Figure 2 shows the recent trend in the number of inflation words in the Beige Book. We counted the number of times the words “wage,” “skilled,” “shortage,” “widespread,” and “rising” appeared in recent editions of the Beige Book. In October 2015, these words appeared 110 times, similar to the 116 in September but above the 99 in July 2015. The September/October readings were the highest count so far this year. In all of 2014–when deflation, not inflation, was a concern–those words appeared, on average, 98 times per Beige Book. During 2011-13, also a period when heightened risk of deflation was evident, inflation words appeared, on average, 80 times per Beige Book. We’ll continue to monitor this trend closely, as the FOMC has told markets that it will begin raising rates when it is “reasonably confident” that inflation will move back toward 2.0%.

COMMENTS ON OIL & ENERGY STABILIZE AT A HIGH LEVEL

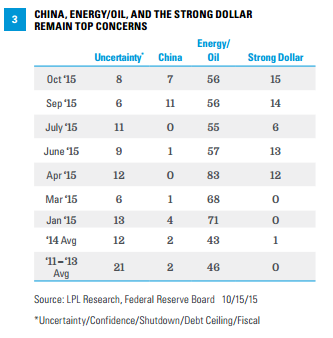

Oil and energy received a total of 56 mentions in the October 2015 Beige Book, in-line with the prior 3 Beige Books dating back to June 2015, but below the average of 74 mentions per Beige Book seen over the first 3 Beige Books released in January, March, and April 2015. For context, energy and oil had around 40-45 mentions per Beige Book in 2011-14 [Figure 3]. Guidance from corporate managements in the manufacturing sector, surveys of manufacturing activity, and “hard” data on manufacturing orders and shipments have been downbeat of late. However, the relative stability in the number of mentions of oil and energy in the Beige Book suggests that the worst may be over for the capital spending cuts, rig count reductions, and job losses in the oil and gas sector.

To better gauge the impact of lower oil prices on the economy, we recently constructed a separate Beige Book Barometer [Figure 4] for the three Fed districts with the most energy-related economic activity (Minneapolis, Kansas City, and Dallas). During 2014, the Beige Book Barometer in the energy-related Fed districts averaged +18. In the first 7 Beige Books of 2015, the barometer in the energy-related districts was just +10, a clear deceleration in activity. After a bounce from +2 in April 2015 to +18 in September 2015, the energy-related barometer dipped to just +2 again in October 2015, matching the April 2015 low. With oil prices year to date averaging around $51 per barrel–45% below the 2014 average price of $92 per barrel–and the year almost over, companies in the oil and gas sector may be throwing in the towel. In one interesting anecdote from the Beige Book on this front, contacts in Houston noted that buyer traffic and sales of high-end apartments have slowed. Still, we point out that even in places like Texas, Louisiana, and Oklahoma, energy accounts for less than 20% of gross domestic product (GDP). However, in the June, July, September, and October 2015 Beige Books, the number of weak words in the energy-related Fed districts (59) alone accounted for one-third of all weak words (171) in the entire Beige Book, indicating that the economic weakness related to the oil and gas sector is still significant.

As was the case in the Beige Books released thus far in 2015, the October 2015 Beige Book provided many comments from all 12 Fed districts about how lower fuel and energy prices were benefiting multiple industries. In short, comments on the impact of falling oil prices are consistent with our view that falling oil prices will be a net plus for the U.S. economy as a whole, but economies in certain states could see a significant impact from the additional slowdown in drilling activity that is likely to occur over the next 6-9 months or so. (Please see our Weekly Economic Commentary, “Drilling into the Labor Market,” for more details. In addition, see the Weekly Market Commentary, “Oil’s Long Bottoming Process,” for our latest view on oil prices.)

FADING CONCERNS/RISING CONCERNS

Uncertainty around fiscal policy has continued to fade as a concern; however, in some cases it has been replaced by uncertainty surrounding China, the drop in oil and other commodity prices, the stronger dollar, and what all these might be signaling for global growth.

Looking ahead, the fiscal concerns may pick up over the next several Beige Books if Congress doesn’t act soon to address the debt ceiling and funding for the federal government. The U.S. Treasury is likely to hit its congressionally mandated borrowing limit in early November, and the funding to run the federal government is set to run out in early December.

China had 7 mentions in the latest Beige Book and 18 in the past 2 Beige Books. The 18 mentions of China in the past 2 Beige Books (September and October 2015) surpass the total number of mentions of China in all 8 of the Beige Books released in 2014 [Figure 3]. China averaged only 2 mentions per Beige Book from 2011-14. As we noted in the Weekly Economic Commentary, “China Challenge,” while the Chinese economy has been slowing for more than 5 years, the news media and U.S. financial markets have only recently seemed to have taken note. As has been the case this year, most, if not all, of the mentions of China in the latest Beige Book were in a negative context, but many were also confined to the industrial or manufacturing sector. We continue to expect China to be a key topic in the Beige Book for the foreseeable future.

The concerns about a stronger dollar continued in the latest Beige Book. There were 20 mentions of the dollar in the October 2015 Beige Book [Figure 3], 15 of which were specifically about the “strong dollar,” matching the count in September. To put these readings in context, the strong dollar was mentioned, on average, just 1 time per Beige Book in 2014, and got virtually no mentions in 2011-13. While the concern on the strong dollar is mainly from manufacturers, retailers who cater to overseas customers and tourism contacts in areas that traditionally attract overseas tourists (New York, Florida, Nevada, California) also cited the strong dollar as a drag on business.

OPTIMISM STILL RULES

Of the major transitory factors that impacted the economy and the Beige Book in early 2015 (dollar, oil, port strike, bad weather), only oil and the strong dollar remain as concerns. However, neither the dollar nor the other headlines has dampened the optimism on the economy, which has picked up strength in the past year or so.

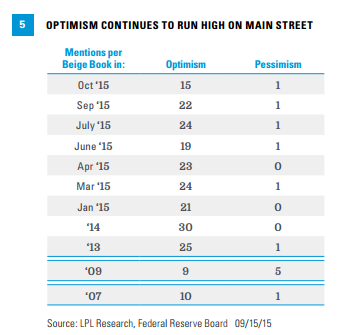

In the October 2015 Beige Book, the word “optimism” (or its related words) appeared 15 times, whereas the word “pessimism” appeared just once [Figure 5]. Over the first 7 Beige Books of 2015, optimism has appeared, on average, 21 times per Beige Book, while the word pessimism has appeared a total of just 5 times across all 7 Beige Books in 2015, with 3 of the 5 mentions coming in the Dallas and Kansas City districts, who were commenting on the outlook for the oil and gas sector.

As reassuring as it is to see that Main Street can remain optimistic despite the flow of bad news, the large number of optimistic comments in the Beige Book is not the start of a new trend: In the 8 Beige Books released in 2014, the word “optimism” appeared, on average, 30 times. In 2013, “optimism” appeared, on average, 25 times per Beige Book. In the 8 Beige Books released in 2009, during some of the worst of the financial crisis and Great Recession, the word “optimism” appeared, on average, just 9 times.

Concerns that today’s economic and market environment is similar to the onset of the Great Recession and the stock market peak in late 2007 also appear to be misplaced. In the 8 Beige Books released in 2007, the word “optimism” appeared, on average, just 10 times per edition–a far cry from the 30 times per edition in the 8 Beige Books released in all of 2014 and the 21 times per edition thus far in 2015.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for your clients. Any economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets as well as weather, geopolitical events, and regulatory developments.

Because of its narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a nondiversified portfolio. Diversification does not ensure against market risk.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

Currency risk is a form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-431453 (Exp. 10/16)