KEY TAKEAWAYS

- Markets remain concerned with China’s stock market and its potential impact on global economic growth.

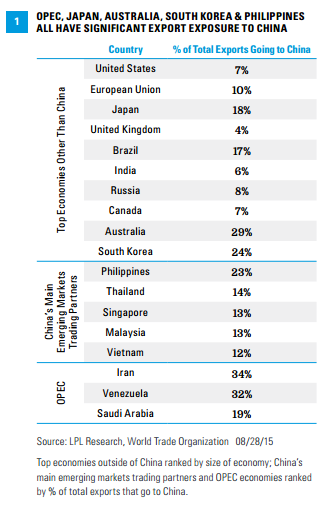

- Although the U.S. only sends 7% of its exports to China, several of the world’s top economies have large export relationships with China.

- Despite China’s ongoing slowdown since 2010, media attention has risen sharply in recent weeks.

Click here to download a PDF of this report.

CHINA CHALLENGE

Markets remain concerned that any damage done by the almost 40% drop in the Chinese equity markets since midyear will spill over into the Chinese economy, which, in turn, could slow global economic growth. During earnings season for the second quarter of 2015, several large U.S. multinational companies sounded cautious on China’s economy in the near term, most notably firms selling into China’s real estate and construction businesses. On balance, while generally acknowledging that overall economic growth in China may have hit a speed bump in the second quarter, many of these same firms continue to be upbeat on China in the medium and long term and continue to cite the rise of the Chinese middle class as a key driver of their sales in China in the coming years. The latest data suggest that S&P 500 companies derive less than 5% of sales directly from China.

S&P IS NOT GDP

Although the comments on China from managements of S&P 500 firms doing business in China are noteworthy, it’s important to remember that “S&P is not GDP,” and S&P 500 companies have different drivers for earnings growth than the components that drive gross domestic product (GDP) growth. Most small and medium-sized U.S. companies and financial firms have little, if any, exposure to China; 7% of U.S. exports are destined for China, and the relatively low level of exposure to China economy-wide can be seen in the Federal Reserve’s (Fed) Beige Book (a qualitative assessment of economic and banking conditions in each of the 12 Fed districts). The word “China” did not appear in the Beige Book released on July 15, 2015, and appeared just twice in the Beige Book released in early June 2015. In the five Beige Books released in 2015, China has received a total of just six mentions–about one mention per Beige Book. Looking back, China was mentioned twice, on average, in each Beige Book released in 2014. Earlier in the expansion (2011-2013) China also got, on average, two mentions per Beige Book, despite the fact that China’s economy has been slowing since 2010. On balance, the limited mentions of China in the Beige Book are consistent with the U.S. economy’s limited exposure to Chinese economic activity.

As we note often, for S&P 500 profits, global growth matters, not just U.S. growth, and the decision by Chinese authorities in early August to devalue the yuan (making Chinese exports less expensive to world markets but raising the cost of exporting to China) is often cited as a drag on global growth. The U.S. sends just 7% of its exports to China. Among the other top 15 largest economies in the world, Australia (29% of exports destined for China), South Korea (24%), Japan (18%), Brazil (17%), and the European Union (10%) all have large export relationships with China. Outside the top 15 largest economies, Thailand, Malaysia, Singapore, and Vietnam all send between 10 and 15% of their exports to China, while the Philippines sends nearly a quarter of its merchandise exports to China. OPEC members Iran (34%), Venezuela (32%), and Saudi Arabia (19%) also have large trade exposure to China, with each providing energy products crucial to China’s manufacturing and transportation sectors [Figure 1]. So while the U.S. has only limited direct exposure to China’s economy, the spillover effect of slower growth in countries like Australia, Japan, South Korea, and Brazil on the U.S. economy is more pronounced. In addition, the slowdown in China has contributed to lower global commodity prices like oil, which–all else equal–is a net positive for the U.S. economy, as a net importer of oil.

CHINA’S SLOWDOWN CONTINUES

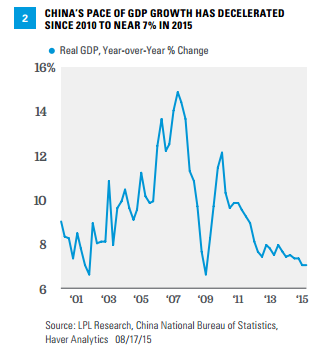

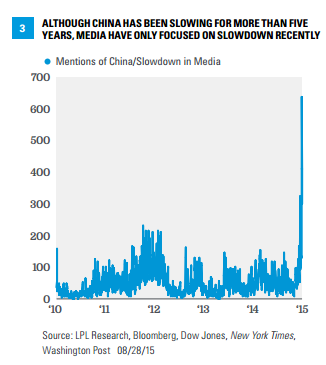

China’s economic growth has been slowing since the first quarter of 2010, when China’s economy posted a 10.1% year-over-year increase [Figure 2]. Since then, China’s property bubble (which continued to inflate in 2010-2013 despite the slowing economy) has burst and, of course, China’s domestic equity market, which ran up about 160% between mid-2014 and mid-2015, has corrected by about 40%. In short, the slowdown in China’s economic and financial markets is not new. However, news coverage of the slowdown in China suggests it is. Figure 3 shows that the number of times the words “China” and “slowdown” have appeared in the same news story in key sources likeThe Wall Street Journal, Bloomberg News, Dow Jones Newswire, and The New York Times has risen sharply in recent weeks.

On average, in the seven days ending August 27, 2015, “China” and “slowdown” appeared together in nearly 400 news stories per day, hitting a peak of nearly 600 on Monday, August 24, 2015. Since the start of August 2015, an average of 188 news stories per day have included the words “China” and “slowdown.” In July 2015, the count was just 63 per day; and in the first six months of 2015, just 43 stories per day had the words China and slowdown. The last time the count was as high as 200 per day on a sustained basis was in the middle of 2012, but as Figure 3 clearly indicates, even though China has been slowing since early 2010, the slowdown has not received a great deal of sustained attention from the news media until very recently.

THE WEEK AHEAD

Although the market’s focus this week (August 31 through September 4, 2015) will likely be on key U.S. economic reports for August (the Institute for Supply Management’s [ISM] manufacturing Purchasing Managers’ Index [PMI], vehicle sales, and the employment report), the Beige Book will also garner plenty of attention, especially as it relates to China’s impact on the U.S. economy.

CONCLUSION

News media will often catch hold of a story when it becomes a catalyst for market volatility even if the news they are reporting isn’t really all that new. Recognition that China’s growth would slow has been in place for years, with the debate really focused on whether it would be a “hard landing” or “soft landing,” and the recent spike in interest has been telling us more about the market mood than about China. China is the world’s second-largest economy and what happens there matters, but the impact on the U.S. has been relatively muted due to low export exposure. China still has a tough road to navigate as it transitions to a more consumer-focused economy, and the impact of its slowdown on commodity demand will be felt for some time, but until we learn something genuinely new, we’ll continue to view the likely potential impact on U.S. markets to be limited.

IMPORTANT DISCLOSURES

The economic forecasts set forth in the presentation may not develop as predicted.

All performance referenced is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing in stocks includes numerous specific risks, including: the fluctuation of dividend, loss of principal, and potential illiquidity of the investment in a falling market.

Because of its narrow focus, specialty sector investing, such as in healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets, as well as weather, geopolitical events, and regulatory developments.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

Currency risk is a form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged.

INDEX DEFINITIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Purchasing Managers’ Indexes (PMI) are economic indicators derived from monthly surveys of private sector companies, and are intended to show the economic health of the manufacturing sector. A PMI of more than 50 indicates expansion in the manufacturing sector, a reading below 50 indicates contraction, and a reading of 50 indicates no change. The two principal producers of PMIs are Markit Group, which conducts PMIs for over 30 countries worldwide, and the Institute for Supply Management (ISM), which conducts PMIs for the U.S.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1- 415949 (Exp. 08/16)