KEY TAKEAWAYS

- Q2 GDP results to date suggest global growth in 2015 is accelerating versus 2014, despite some high-profile GDP misses and China concerns.

- The Eurozone appears to have some economic momentum after nearly a half-decade of sluggish growth, with Q2 GDP acceleration expected.

- Japan’s expected weak Q2 GDP results may be due to temporary factors, but the BOJ stands ready to enact more QE if needed.

Click here to download a PDF of this report.

GLOBAL GDP TRACKER: SUMMER 2015 EDITION

Market participants and the financial media have recently been hyper-focused on the sell-off in Chinese equity prices, the sluggish pace of the Chinese economy, and the implications of both for global growth. The results thus far suggest that global growth in 2015 is indeed accelerating versus 2014. We last wrote about global growth in mid-July 2015 (“Gauging Global Growth: An Update for 2015 & 2016”), noting that the market continues to expect that global gross domestic product (GDP) growth will accelerate in 2015, 2016, and 2017, aided by lower oil prices and stimulus from two of the three leading central banks in the world. Since then, the United States (23% of global GDP), China (13%), the United Kingdom (4%), South Korea (2%), Indonesia (1%), Sweden (1%), and Singapore (less than 1%) have reported Q2 GDP. Together, those countries account for nearly 45% of global GDP. Second quarter 2015 GDP in four of the seven nations beat or matched consensus expectations (China, Indonesia, the United Kingdom, and Sweden), while five of the seven countries reported results that either were in-line with or accelerated versus the prior period (China, the United States, Indonesia, the United Kingdom, and Sweden).

This week (August 9-15, 2015), another six countries are scheduled to report Q2 GDP figures, including the Eurozone (24% of global GDP), Japan (6%), Russia (2%), Poland (1%), Thailand (less than 1%), and Malaysia (less than 1%). Together, these nations–a nice mix of both developed (Eurozone and Japan) and emerging market (Russia, Thailand, Poland, and Malaysia) countries–account for 35% of global GDP, which means by the end of the week, countries representing nearly 80% of global GDP will have reported Q2 GDP data [Figure 1]. Over the second half of August another 10-15% of global GDP will report Q2 GDP, including Brazil, India, Mexico, and Canada, along with Australia, South Africa, the Philippines, Switzerland, and Norway, again providing further insight into both developed and emerging market economies in the second quarter.

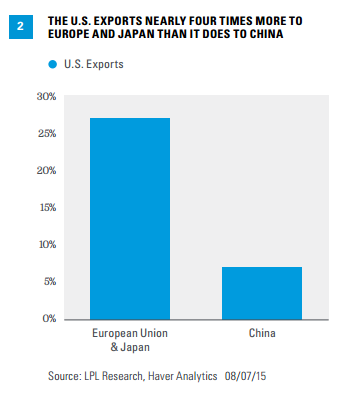

At 13% of global GDP, there’s no question that China matters for global growth, and especially for growth in commodity-producing emerging market (Brazil, Russia, South Africa, etc.) and developed (Canada, Australia) economies. But amid the concern around China, what often gets ignored is the relatively good news out of the Eurozone and Japan, which combined are almost three times larger than China and have more impact on U.S. growth prospects than China. Why? Just 7% of U.S. exports head to China, while nearly 30% of U.S. exports are destined for the European Union and Japan [Figure 2].

EUROPE: SOME MOMENTUM AFTER A HALF-DECADE

According to the consensus of economists, the Eurozone’s GDP is expected to accelerate to 1.3% year over year in Q2 2015 from a 1.0% reading in Q1 2015. While tepid compared with growth in China (7%) and even the U.S. (3%), the expected 1.3% gain in GDP in Q2 2015 represents a major acceleration from the 0.5% growth rate posted, on average, in the Eurozone in 2011 through the end of 2014, weighed down by a broken financial transmission mechanism (the ability and willingness of European banks and financial institutions to make loans to businesses and households in Europe) and concerns over the fate of Greece. Today, the European Central Bank is actively engaged in quantitative easing (QE) and has promised to keep doing QE until at least September 2016, or until it works. QE has helped to unstick the Eurozone’s financial transmission mechanism, and the region’s banking sector–though still struggling–is now finally beginning to lend again. On the trade front, while the slowdown in China is important at the margin, and trade with China has been growing in recent years, only about 5% of Europe’s exports go to China. In short, the Eurozone appears to finally have some economic momentum after nearly a half decade of sluggish growth.

JAPAN: BOJ POISED TO ENACT MORE QE IF NEEDED

Consensus forecasts call for a 0.5% decline in GDP in Japan between Q1 and Q2 2015, after the solid 1.0% increase in Q1 2015. Japan’s expected weakness in Q2 GDP may prove to be temporary, as the weak readings on consumer spending in recent months are likely the result of bad weather in Q2 rather than a pullback in consumer confidence. Indeed, recent readings on business and consumer sentiment in Japan remain at multiyear highs, suggesting that the Bank of Japan’s (BOJ) massive QE program is having its intended effect. Still, if growth falters beyond Q2, the BOJ stands ready to do more QE to help raise domestic inflation expectations and further weaken the yen. The weakness in the Chinese economy poses a larger threat to Japan’s GDP, however, as 19% of Japan’s exports are destined for China, making China Japan’s biggest customer.

CONCLUSION

Despite some high-profile “misses” on global GDP in Q2 2015, and amid continued concern around China’s near-term growth trajectory, global GDP still appears to be on track to accelerate in 2015 versus 2014. Importantly, if growth does begin to falter, central banks around the globe stand ready to do more to boost growth if necessary. For more on the impact of monetary policies on global growth, see our infographic, “LPL Research’s Monetary Policy Impact Monitor,” on pages 12-13 of the Midyear Outlook 2015: Some Assembly Required.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for your clients. Any economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

DEFINITIONS

Quantitative easing (QE) refers to the Federal Reserve’s (Fed) current and/or past programs whereby the Fed purchases a set amount of Treasury and/or mortgage-backed securities each month from banks. This inserts more money in the economy (known as easing), which is intended to encourage economic growth.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-408689 (Exp. 08/16)