KEY TAKEAWAYS

- Fixed income markets showed signs of a growth scare in July 2015, with lower real yields, lower inflation expectations, and a flatter yield curve.

- The markets’ reaction may be a signal to the Fed that September 2015 is too early for an interest rate increase.

- Recent growth concerns may be creating opportunities.

Click here to download a PDF of this report.

SUMMER GROWTH CONCERNS

The fixed income markets exhibited signs of a growth scare in July as inflation-adjusted, or real, yields fell over the month. The decline in real yields, along with lower inflation expectations and a flattening yield curve, all reflect the market’s downgraded assessment of future economic growth.

GROWTH SIGNS REVERSED

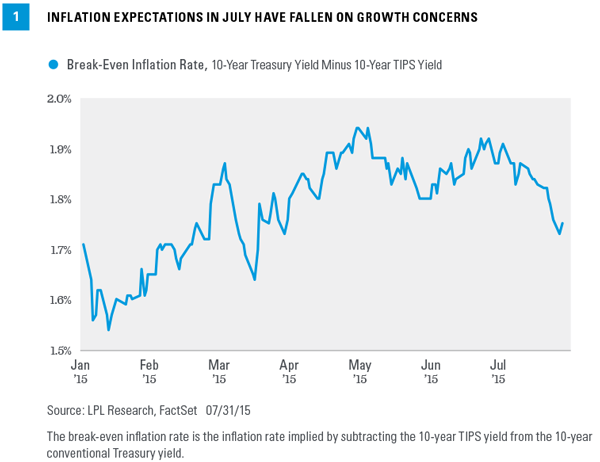

Signs of growth picked up for the domestic economy over the second quarter of 2015 and, as a result, inflation expectations were on the rise throughout the quarter. Housing data were the standout, existing home sales in June moved to an annualized rate of 5.5 million, the highest since February 2007. Strong consumer spending was another bright spot. Data released so far in the third quarter–such as a slowdown in retail sales figures and weak readings on wage growth–have been mixed and helped push inflation expectations down on the prospects of lower than anticipated growth [Figure 1].

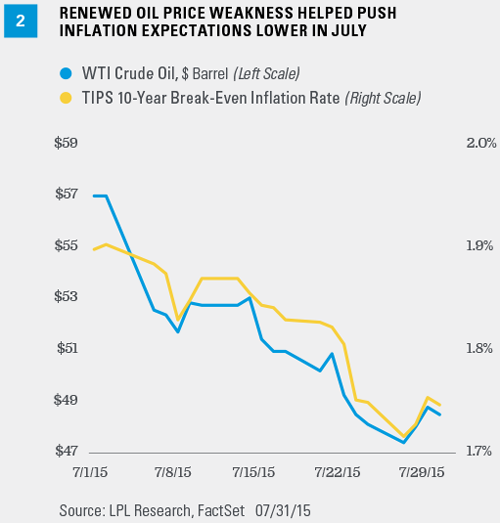

While concerns over China’s economy and equity markets put downward pressure on global growth expectations, the price of oil was a big driver of U.S. inflation expectations. Oil prices have declined on continued supply concerns: a slight rise in U.S. rig counts, additional Iranian supply, and comments from Russia and OPEC that production cuts in the near future are unlikely. Figure 2 shows how the price of oil and inflation expectations have moved together during July.

It is worth noting that one of the Federal Reserve’s (Fed) mostly closed tracked inflation metrics, the 5-year forward, 5-year inflation rate–the estimated 5-year inflation rate, 5 years from now–has declined only slightly in comparison to the Treasury Inflation-Protected Securities (TIPS) 10-year break-even rate. Since TIPS inflation compensation is closely tied to the Consumer Price Index (CPI), it is influenced more by oil prices, whereas the Fed’s forward measure is a cleaner read of longer-term inflation expectations.

REAL YIELDS STALL

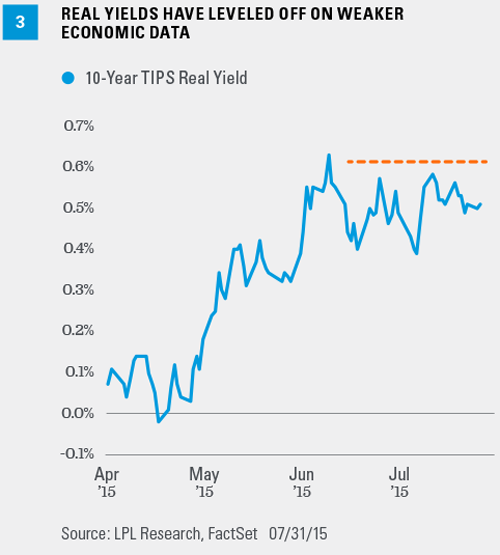

Similar to inflation expectations, real yields have declined slightly in recent weeks. Real yields can be viewed as a proxy for expected long-term economic growth. Higher real yields, all else equal, indicate higher economic growth expectations. Real yields rose in the second quarter but have leveled off since the beginning of the third quarter [Figure 3].

FED RATE HIKE ON TRACK

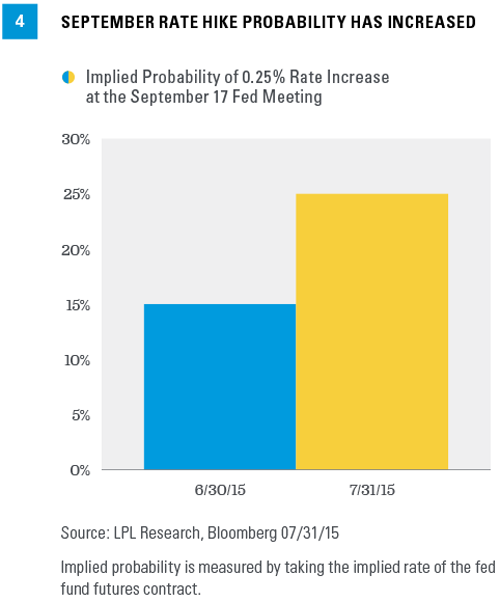

Despite a moderate economic backdrop, the Fed has held firm with its prescription of likely Fed rate hikes in 2015. During her prepared remarks to Congress in July, Fed Chair Janet Yellen said, “If the economy evolves as we expect, economic conditions likely would make it appropriate at some point this year to raise the federal funds rate target, thereby beginning to normalize the stance of monetary policy.” The markets have been calling the Fed’s bluff on potential rate hikes for some time now, but it seems that market participants are now taking the Fed’s rhetoric more seriously [Figure 4]. The decline in real yields and inflation expectations, along with a flatter yield curve, could be a signal from markets that now may be a bad time to start hiking rates.

Rising expectations of a September rate hike and lukewarm economic data have translated to a flatter yield curve, as short-term Treasury yields have increased slightly while longer-term Treasury yields declined in recent weeks. Short-term yields have been rising on increased belief the Fed will, in fact, raise interest rates in the near future. Long-term yields have been falling, however, on lackluster economic data and the belief that a Fed rate hike, if it comes soon, may hinder the economy. Though the curve has been flattening, it is still steeper year to date and steep from a historical perspective. The curve is far from flat or inverted, and is thus not showing signs of an impending recession.

BUYING FEAR

Growth concerns may have created opportunities. The average yield of the high-yield bond market, as measured by the Barclays High Yield Index, moved above 7% in late July, the highest yield since the end of 2014. Prior to the end of 2014, the average yield had not reached 7% since July 2013. Although highly influenced by the energy sector and price declines in response to lower oil prices, higher overall yields in the high-yield bond market may present an opportunity. Recent gross domestic product (GDP) revisions revealed a slower recovery following the Great Recession but also show a healthy pace of growth in 2015. First quarter 2015 GDP was revised upward from -0.2% to 0.6%, and the first look at second quarter GDP still shows a sizable bounce in growth. We continue to believe the economy is on track to expand at a 3.0% rate for the second half of 2015.* While the threat of a September rate hike may have increased, we believe recent growth fears may be misplaced and believe a December 2015 or early 2016 rate liftoff to be more likely than September 2015.

*As noted in the Outlook 2015, LPL Research expects GDP to expand at a rate of 3% or higher, which matches the average growth rate of the past 50 years. This is based on contributions from consumer spending, business capital spending, and housing, which are poised to advance at historically average or better growth rates in 2015. Net exports and the government sector should trail behind.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

Treasury Inflation-Protected Securities (TIPS) help eliminate inflation risk to your portfolio, as the principal is adjusted semiannually for inflation based on the Consumer Price Index (CPI)-while providing a real rate of return guaranteed by the U.S. government. However, a few things you need to be aware of is that the CPI might not accurately match the general inflation rate; so the principal balance on TIPS may not keep pace with the actual rate of inflation. The real interest yields on TIPS may rise, especially if there is a sharp spike in interest rates. If so, the rate of return on TIPS could lag behind other types of inflation-protected securities, like floating rate notes and T-bills. TIPS do not pay the inflation-adjusted balance until maturity, and the accrued principal on TIPS could decline, if there is deflation.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Barclays High Yield Index covers the universe of publicly issued debt obligations rated below investment grade. Bonds must be rated below investment grade or high yield (Ba1/BB+ or lower), by at least two of the following ratings agencies: Moody’s, S&P, and Fitch. Bonds must also have at least one year to maturity, have at least $150 million in par value outstanding, and must be U.S. dollar denominated and nonconvertible. Bonds issued by countries designated as emerging markets are excluded.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-407025 (Exp. 08/16)