KEY TAKEAWAYS

- Emerging markets debt (EMD) spreads have moved above 4%, a level that has attracted buying interest in recent years.

- EMD is more sensitive to interest rates than the broad U.S. fixed income market.

- We continue to favor high-yield bonds due to their lower interest rate sensitivity.

Click here to download a PDF of this report.

CHINA’S EFFECT ON EMERGING MARKETS DEBT

Volatile Chinese equity markets have been a popular topic of late, but impacts to broader emerging market countries appear limited. Equity market movements do not necessarily influence economic conditions; and it is also important to keep in mind that mainland Chinese stocks, as measured by the Shanghai Composite Index, are still over 15% higher year to date (through Monday, July 26) even after the recent correction. Furthermore, while China is a major force in emerging markets, it only holds a weighting of 5.6% in the J.P. Morgan Emerging Markets Bond Global Index (EMBI), making it the sixth-largest component. So while China may be the cause of recent media headlines, there are other, more impactful drivers of emerging markets debt (EMD) performance.

SPREADS DRIVE RETURNS

One of the major drivers of EMD performance is the yield spread between EMD and comparable maturity Treasuries. A narrowing EMD yield spread, either in an up or down market, indicates EMD is outperforming comparable maturity Treasuries, and vice versa, with a widening yield spread. Yield spreads are a measure of risk premiums, and a changing yield spread reflects changing risks due to a variety of drivers, including economic growth expectations, country-specific risks, and currency fluctuations. Expanding yield spreads indicate rising risk premiums and that investors require a higher level of return for the asset class, likely due to an increased perception of risk.

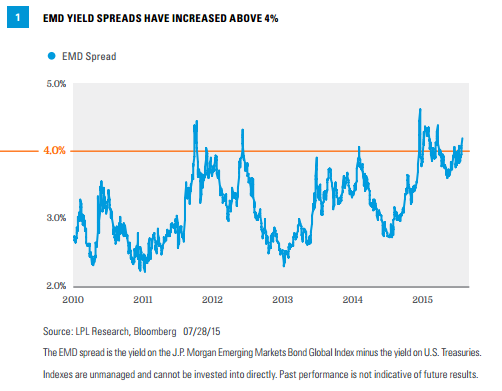

The average EMD yield spread recently increased above 4%, which has been a point of buying interest over the past five years [Figure 1]. Higher yield spreads imply more attractive valuations; an average yield spread above 4% has been rare in recent years and an indicator of value.

EMERGING MARKETS ARE NOT CREATED EQUAL

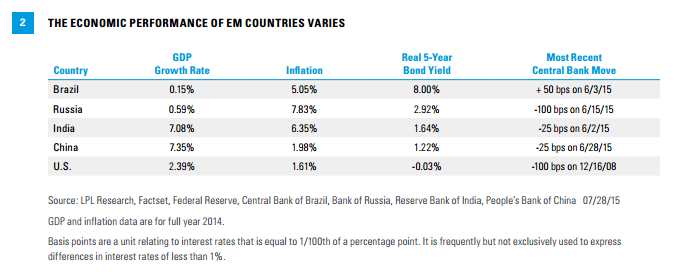

Though emerging markets are often discussed as if they are a group of countries that share similar characteristics and performance, this isn’t always the case. While emerging markets are generally expected to grow faster than their developed counterparts, similarities often end there. More than 60 countries are represented in the EMBI, but investors don’t have to dig through all of them to identify differences in economic expectations. Figure 2 shows the variability in economic growth rates, inflation, real five-year bond yields (nominal yields minus inflation), and recent central bank moves among the well-known BRIC (Brazil, Russia, India, and China) countries. U.S. data are also included for comparison purposes, and one point of note is that the real five-year government bond yields for each of the BRIC countries exceed that of the U.S, which is another sign of attractive valuations. The diverse nature of emerging market economies, and the fact that data are typically not as plentiful or easy to access as in developed markets, are two reasons why we believe active management may make sense for the EMD asset class.

Aside from Chinese contagion, lower oil prices, the strong dollar, and the start of Federal Reserve (Fed) rate hikes are generally being viewed as risks to EMD. Of these, we view the possibility of Fed rate hikes as least threatening because the start of interest rate increases has been widely anticipated, and over the past two years, many emerging market countries have reduced their dependency to foreign capital flows. Lower oil prices can have offsetting impacts, as lower prices adversely impact oil-exporting countries but benefit energy importers. A stronger U.S. dollar is perhaps a more serious threat, because a rising dollar increases the cost of dollar-denominated EMD to an issuing country. Emerging market exporters receive less local currency in response to a stronger dollar, which can restrain growth. Still, these risks may be accounted for with an average yield spread above 4%.

LOCAL VERSUS HARD CURRENCY

Currency moves can have a large effect on EMD returns, and the strength of the U.S. dollar has been a headwind for local currency denominated EMD. EMD can be issued in either the issuer’s local currency, or major international currencies (referred to as hard currency), such as the U.S. dollar (most common) or euro. Governments generally prefer to issue in local currencies where possible, although this may not be feasible for many reasons, including low levels of liquidity and volatility in currency markets that leads to low levels of demand from foreign investors. For countries that cannot issue in local currency, bonds can be issued in hard currency to make them more attractive to international investors. While this reduces the risk of currency devaluation to the investor, it increases the risk to the issuing country, as it will have to use its own local currency to buy the hard currency used for principal and interest payments. From an investor standpoint, local currency EMD is more volatile due to the currency fluctuation for a U.S.-based investor. Conversely, hard currency EMD is primarily dollar denominated, and therefore, is not impacted by such currency movements.

INTEREST RATE SENSITIVITY

Most investors may not realize the potential interest rate sensitivity of EMD investments. The EMBI, with a duration of 7.1, is more interest rate sensitive than the Barclays U.S. Aggregate (duration of 5.5). Although we do not expect interest rate levels to rise quickly, an increase in rates may have a larger effect on EMD than on the broader U.S. fixed income market, which may be a headwind for the sector.

CONCLUSION

While the economic risks in China will likely continue to make headlines, so far Chinese equity market weakness has had limited follow-through to emerging market fundamentals. Nonetheless, average yield spreads have increased in response to China’s stock market volatility and also due to U.S. dollar strength. An average yield spread of 4% or more factors in a lot of these risks and has provided investors opportunity in the past. Still, a longer average duration for the EMBI is a potential headwind in the event that interest rates rise, especially relative to domestic high-yield bonds, which offer higher yields and have historically exhibited much less interest rate sensitivity.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Duration is a measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates. It is expressed as a number of years. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices. The bigger the duration number, the greater the interest rate risk or reward for bond prices.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Investing in foreign fixed income securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with foreign market settlement. Investing in emerging markets may accentuate these risks.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

JP Morgan Emerging Markets Bond Global Index (EMBI Global) tracks total returns for traded external debt instruments in the emerging markets, and is an expanded version of the JP Morgan EMBI+. The EMBI Global includes U.S. dollar denominated Brady bonds, loans, and Eurobonds with an outstanding face value of at least $500 million.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-404926 (Exp. 07/16)