KEY TAKEAWAYS

- The latest Beige Book suggests that the U.S. economy is still growing at or above its long-term trend, and that some upward wage pressures continue to emerge.

- Optimism regarding the economic outlook far outweighed pessimism throughout the Beige Book, as it has for the past two years or so.

- Our new Beige Book Barometer for the three Fed districts with the most energy-related economic activity reveals more weakness.

Click here to download a PDF of this report.

BEIGE BOOK: WINDOW ON MAIN STREET

BEIGE BOOK SUGGESTS CONTINUED MODEST ECONOMIC GROWTH

The latest Beige Book suggests that the U.S. economy is still growing at or above its long-term trend, indicating that some of the “transitory factors” that held the U.S. economy back in the first quarter of 2015 have faded and that some upward pressure on wages is perhaps beginning to emerge. Overall, the Beige Book described the economy as expanding at a “modest or moderate” pace in most districts. In general, optimism regarding the economic outlook far outweighed pessimism throughout the Beige Book, as it has for the past two years or so.

The Beige Book is a qualitative assessment of the U.S. economy and each of the 12 Federal Reserve (Fed) districts. We believe the Beige Book is best interpreted quantitatively by measuring how the descriptors change over time. The latest edition of the Fed’s Beige Book was released Wednesday, July 15, 2015, ahead of the July 28-29 Federal Open Market Committee (FOMC) meeting. The qualitative inputs for the July 2015 Beige Book were collected from late May 2015 through July 3, 2015; thus, they captured a period of:

- Increased financial market volatility due to Greece’s debt problems

- Generally better than expected U.S. economic data for May and June 2015, despite a disappointing bounce back in U.S. economic activity in the second quarter following the first quarter disruptions (port strike, bad weather, strong U.S. dollar)

- Some stability in oil prices, with oil near $60 per barrel during the reference period

- A 21% decline in Chinese equity prices, which prompted fears of a recession in China

- The U.S. Supreme Court’s Affordable Care Act (ACA) decision

SENTIMENT SNAPSHOT

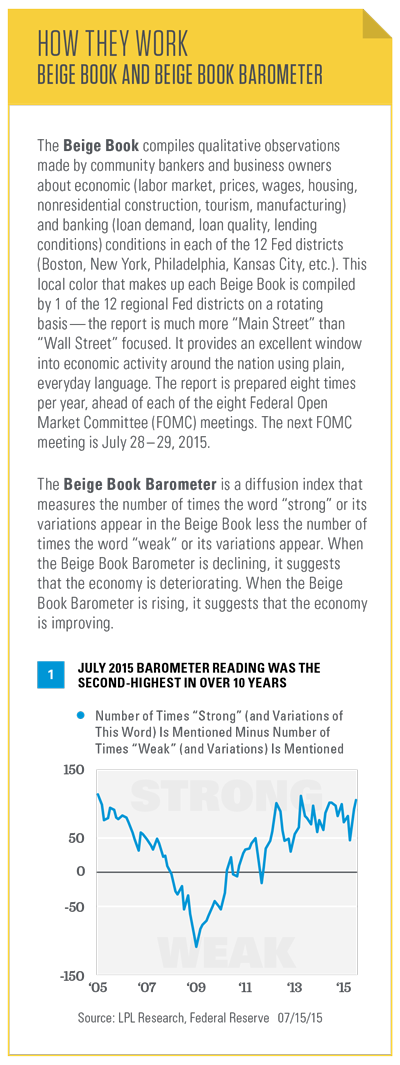

To provide a snapshot of the sentiment behind the entire Beige Book collage of data, we created our proprietary Beige Book Barometer (BBB) [Figure 1]. In July 2015, the barometer moved up to +106 from +92 in June 2015 and +47 in April 2015. The +106 reading in July 2015 was the highest reading since April 2013, and the second-highest reading in over 10 years.

Much was made of the fact that the word “weak” or its variants appeared 52 times in the June 2015 Beige Book (versus 44 in April 2015), and indeed, it was the highest number of weak words in the Beige Book since 2011, during the worst of the European debt crisis of that year and the aftermath of the U.S. debt downgrade and debt ceiling debacle. In the July 2015 Beige Book, the word “weak” or its variants appeared just 29 times–despite all the angst in the media and markets around Greece and China. Overall, the drop in the number of weak words between June and July 2015 (the strong word count dipped as well) supports the Fed’s view that the U.S. economic data weakness in the first quarter was transitory, and that many of the headwinds holding back the economy in the first quarter have subsided. Second quarter gross domestic product (GDP) will be reported on July 30, 2015.

WATCHING WAGES & INFLATION

As it has over the past year, the July 2015 Beige Book noted that employers were having difficulty finding qualified workers for certain skilled positions and some reported upward wage pressures for particular industries and occupations. In the past, these characterizations of labor markets have been a precursor to more prevalent economy-wide wage increases. Indeed, for the first time in this business cycle, the latest six Beige Books (going back to December 2014) contained several mentions of employers having difficulty attracting and retaining low-skilled workers, and retaining and compensating key workers.

If this trend persists over the next few Beige Books, history suggests it may not be long until Fed policymakers begin to take note of a faster pace of wage inflation in their monetary policy deliberations. However, based on Fed Chair Janet Yellen’s testimony to Congress in mid-July 2015 and other recent commentary from Fed officials, FOMC members are not yet worried about rising wages, and indeed, cannot come to general agreement that wages should even play a part in measuring inflation pressures in the economy.

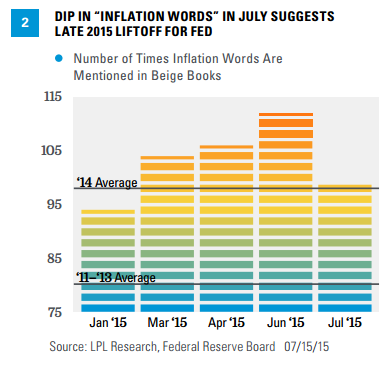

Figure 2 shows the recent trend in the number of “inflation words” in the Beige Book. We counted the number of times the words “wage,” “skilled,” “shortage,” “widespread,” and “rising” appeared in recent editions of the Beige Book. In July 2015, these words appeared 99 times, down from the counts recorded in the last three Beige Books (104 in March 2015, 106 in April 2015, and 112 in June 2015), perhaps reflecting the recent soft reading in wages, stability in oil, and sizable drop in agricultural prices. In all of 2014–when deflation, not inflation, was a concern–those words appeared, on average, 98 times per Beige Book. During 2011-13, also a period when heightened risk of deflation was evident, the “inflation words” appeared, on average, 80 times per Beige Book. We’ll continue to monitor this trend closely, as the FOMC has told markets that it will begin raising rates when it is “reasonably confident” that inflation will move back toward 2.0%.

FEWER COMMENTS ON OIL & ENERGY THAN IN PAST BEIGE BOOKS

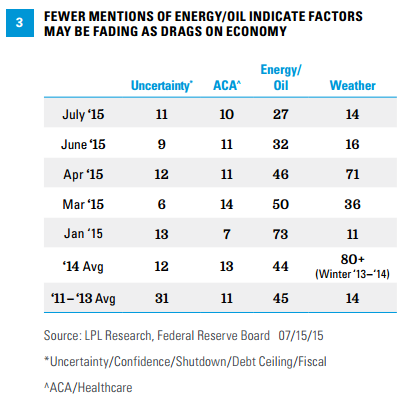

Oil and energy received a combined 27 mentions in the July 2015 Beige Book, the lowest number of mentions in the 2015 Beige Books, and even below the 44-45 mentions per Beige Book in 2011-2104 [Figure 3]. This may suggest that the capital spending cuts, rig count reductions, and job cuts in the oil and gas sector in late 2014 and in the first few months of 2015 may be fading as drags on economic activity. The summary comment on the energy sector in the July 2015 Beige Book captures the situation in the oil and gas drilling sector well: “Oil and natural gas drilling declined in Cleveland, Minneapolis, Kansas City, and Dallas. Coal production was flat in Cleveland and down in Richmond. Energy-related capital expenditures were down in some Districts.”

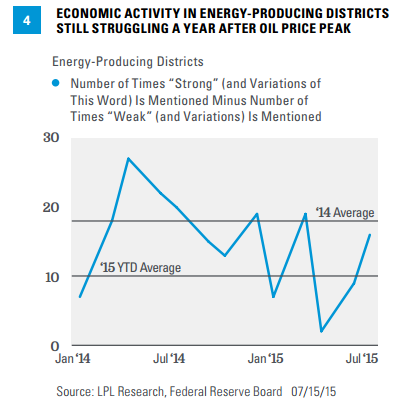

To better gauge the impact of lower oil prices on the economy we constructed a Beige Book Barometer for the three Fed districts that have the most energy-related economic activity (Minneapolis, Kansas City, and Dallas). During 2014, the Beige Book Barometer in the energy-related Fed districts averaged +18. In the first five Beige Books of 2015, the Barometer in the energy-related districts was just +10, a clear deceleration in activity. In the June and July 2015 Beige Books, the number of weak words in the energy-related Fed districts (27) accounted for one-third of all weak words (81), indicating that the economic weakness related to the oil and gas sector is still significant [Figure 4].

As was the case in the April and June 2015 Beige Books, the July 2015 Beige Book was also full of comments about how lower fuel and energy prices were benefiting multiple industries throughout all 12 Fed districts. In short, comments on the impact of falling oil prices are consistent with our view that while falling oil prices will be a net plus for the U.S. economy as a whole, economies in certain states could see significant impacts from the slowdown in drilling activity that is likely to occur over the next six to nine months or so. (Please see our Weekly Economic Commentary, “Drilling into the Labor Market,” January 12, 2015, for more details. In addition, see this week’s Weekly Market Commentary “Oil’s Long Bottoming Process,” for our latest view on oil prices.)

FADING CONCERNS

Uncertainty around fiscal policy has continued to fade as a concern; however, in some cases it has been replaced by uncertainty surrounding the drop in oil prices and what it might signal for global growth. The ACA, and healthcare in general, remained a consistent source of concern among Beige Book respondents; however, the impact has faded a bit recently, with just 10 mentions in the latest Beige Book, despite the Supreme Court’s latest ACA ruling, which was handed down during the survey period. Thus far in 2015, this topic has received an average of 10 mentions per Beige Book, in-line with the number of mentions per Beige Book in 2014 [Figure 3].

Weather continues to receive fewer mentions (16 in June and 14 in July) compared with the 71 mentions in the April Beige Book, indicating the extreme winter weather of early 2015 is also fading as a drag on growth. Despite the effects of this year’s harsh weather, there was a far greater impact in early 2014 when more of the country was affected (early 2014 averaged 80 mentions of weather per Beige Book).

OPTIMISM RULES

Of the major transitory factors that impacted the economy and the Beige Book in early 2015, only the strong dollar lingered (23 mentions in July 2015 versus 30 in June and 31 in April); however, neither the dollar nor the other headlines dampened the optimism on the economy that has picked up strength in the past year or so.

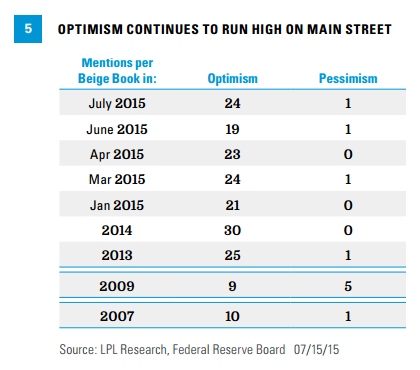

In the July 2015 Beige Book, the word “optimism” (or its related words) appeared 24 times, whereas the word “pessimism” appeared just once. Over the first 5 Beige Books of 2015, optimism has appeared, on average, 22 times per Beige Book, while the word pessimism has appeared a total of just 3 times across all 5 Beige Books in 2015, with 2 of the 3 mentions coming in the Dallas district, commenting on the outlook for the oil and gas sector.

As reassuring as it is to see that Main Street can remain optimistic despite the flow of bad news, the large number of optimistic comments in the Beige Book is not the start of a new trend: In the 8 Beige Books released in 2014, the word “optimism” appeared, on average, 30 times in each edition. In 2013, “optimism” appeared, on average, 25 times per Beige Book. Looking back to the worst of the 2007-09 financial crisis and Great Recession, the word “optimism” appeared, on average, just 9 times in the 8 Beige Books released in 2009.

Concerns that the economic and market environment we are in today is similar to the period just prior to the onset of the Great Recession and stock market peak in late 2007 also appear to be well overdone, based on this metric. In the 8 Beige Books released in 2007, the word “optimism” appeared, on average, just 10 times per edition–a far cry from the 30 times per edition in the 8 Beige Books released in 2014 [Figure 5].

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for your clients. Any economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets as well as weather, geopolitical events, and regulatory developments.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-402321 (Exp. 07/16)