COMPASS CHANGES

- Downgraded REITs to negative/neutral from neutral.

Click here to download a PDF of this report.

INVESTMENT TAKEAWAYS

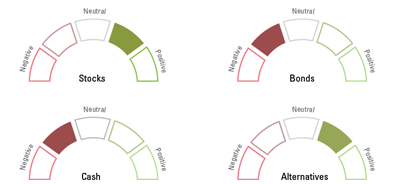

- We forecast high-single-digit S&P 500 returns in 2015* despite the slowdown in earnings due to drags from a strong U.S. dollar and lower oil prices.

- We continue to favor U.S. equities over developed foreign markets; our recently upgraded EM view is driven by improving fundamentals, low valuations, and bullish technicals.

- Our lowered REIT view reflects technical deterioration, while valuations and interest rate risk remain concerns, despite recent weakness.

- Optimism over a Greek resolution and modest improvement in economic data continue to pressure bond prices. Still, yields remain low and valuations above average, suggesting low future returns for high-quality bonds.

- For fixed income allocations, we recommend a defensive duration stance and emphasize a blend of high-quality intermediate bonds and less interest rate-sensitive sectors such as high-yield and bank loans.

- From a technical perspective, the S&P 500 price remains above a positively sloping 200-day simple moving average, which supports a long-term bullish trend.

Please click here for the full Portfolio Compass publication.

*Historically since WWII, the average annual gain on stocks has been 7-9%. Thus, our forecast is in-line with average stock market growth. We forecast a 5-9% gain, including dividends, for U.S. stocks in 2015 as measured by the S&P 500. This gain is derived from earnings per share (EPS) for S&P 500 companies growing 5-10%. Earnings gains are supported by our expectation of improved global economic growth and stable profit margins in 2015.

IMPORTANT DISCLOSURES

Simple moving average is a simple, or arithmetic, moving average that is calculated by adding the closing price of the security for a number of time periods and then dividing this total by the number of time periods.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

All bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and are subject to availably and change in price. High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors. Municipal interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply. Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk, as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

Past performance is no guarantee of future results.

Stock investing involves risk including loss of principal.

Preferred stock investing involves risk, which may include loss of principal.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-388614 (Exp. 06/16)